Shorting the US Dollar: A Guide for Australian Investors | 2025

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

General Disclaimer

Cryptocurrency trading involves significant risks, including the potential loss of your entire investment. Prices can be highly volatile, and past performance is not indicative of future results. Please consider your financial situation, risk tolerance, and seek independent financial advice before engaging in cryptocurrency trading.

Affiliate Disclosure

This page contains affiliate links, meaning we may earn a commission if you click through and sign up with one of our partners. This does not influence our reviews or rankings, which are based on our honest opinions and thorough research.

Updated 25/03/2025

Quick Answer:

Looking to short the US dollar from Australia? Explore smart strategies like forex trading, inverse ETFs, gold, and emerging markets. Whether you’re an expat or investor, learn how to protect your portfolio and profit from a falling USD.

Featured Platform - eToro

- Advanced Security

- AUD Support

- Regulated & Transparent

- Low Fees

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What Does It Mean to "Short" the US Dollar?

Shorting the US dollar is betting that the value of the dollar will go down compared to another currency. In this case, I’m looking at it through the lens of the Australian dollar (AUD).

Currencies always trade in pairs — like USD/AUD. So if I believe the US dollar is going to weaken and the Aussie dollar will strengthen, I can short USD/AUD. It’s like saying, “I think the US dollar is about to drop, so I’m going to position myself to profit when it does.”

I first got serious about this strategy in the aftermath of COVID. Between 2020 and 2022, the US dollar soared as the Federal Reserve hiked rates aggressively. But by late 2022 into 2023, things started to shift — slowing growth, talk of rate cuts, and rising debt all pressured the greenback. That’s when I saw opportunities for investors, especially Australians, to think differently about the dollar.

Why Would an Australian Want to Bet Against the Greenback?

As someone who spends a lot of time watching both US and Australian markets, I’ve noticed growing reasons to be cautious on the US dollar — and more optimistic on the Aussie.

Let’s start with the US side. The American economy, while still large and powerful, has been showing signs of slowing. The Federal Reserve has already hinted at rate cuts, and there’s mounting concern over ballooning government debt. Plus, the global push for “de-dollarisation” — where countries start trading more in currencies other than the USD — is gaining traction.

Now, compare that to the Australian dollar. We’re a commodity powerhouse — iron ore, lithium, LNG — and demand from Asia remains strong. Australia’s ties to the Asia-Pacific region are a long-term strength, especially as China reopens and re-engages economically.

The Reserve Bank of Australia (RBA) has also started charting a slightly different course than the Fed. While the US leans toward cutting rates, the RBA has been more measured — that divergence can boost AUD strength.

And here’s the kicker — if you’re an expat earning in USD or an Aussie investor with exposure to US assets, betting against the greenback isn’t just about making a profit. It’s about protecting your wealth from currency shifts that can eat into your returns.

“The greenback” is a widely used nickname for the US dollar, derived initially from the green-coloured paper currency first issued during the American Civil War.

What Are Your Best Options for Shorting the US Dollar?

Over the years, I’ve tested out a few different ways to short the US dollar — some simple, some more hands-on. If you’re thinking about taking a position against the USD, it is important to match the strategy with your experience level, risk tolerance, and how involved you want to be day to day.

Direct Methods

1. Forex Trading (Shorting USD/AUD)

This was the first method I explored when I really wanted hands-on exposure. Forex trading in Australia lets you directly short the USD against the AUD — you’re literally betting on the AUD rising in value versus the US dollar.

It’s a 24/5 market and highly liquid, but investors should keep in mind: that it is also high risk. You’re often trading with leverage, which means small moves can lead to big gains — or losses. I have used some of the best Forex Brokers in Australia platforms like eToro, Pepperstone, and Saxo, which offer strong tools and tight spreads. However, unless you’ve got trading experience and the time to monitor positions closely, this method probably isn’t where I’d recommend starting.

2. Holding AUD or Converting USD

This is one of the easiest and lowest-risk options — especially if you’re an expat earning in USD. I know traders who have done this when they wanted to reduce exposure to the US dollar without getting fancy.

You can convert some of your USD into AUD and hold it in an Australian bank account or AUD brokerage account. No leverage, no complex instruments — but timing matters, and you’ll want to watch out for FX transfer fees.

Indirect Methods

3. Inverse USD ETFs

If you’re based in Australia but have access to international trading platforms, ETFs like Invesco’s UDN offer a simple way to short the dollar. These funds aim to move opposite the USD — so if the dollar weakens, the ETF goes up.

They’re a great “set and forget” option if you don’t want to actively trade. I’ve used them before to balance out USD-heavy positions in my portfolio.

4. AUD-Hedged Global ETFs

Another indirect approach I use is to invest in international funds that are hedged to the AUD. You’re still investing globally, but you’re not exposed to the ups and downs of the US dollar. Providers like iShares and Vanguard offer AUD-hedged versions of their global ETFs — and they’re perfect if you’re a long-term investor who just wants stability.

Overview of USD Shorting Strategies

| Strategy | Experience Needed | Risk Level | Accessibility | Typical Costs | Best For | Key Considerations |

|---|---|---|---|---|---|---|

| Forex Trading (Short USD/AUD) | High | High | Medium (requires broker account and trading platform) | Low spreads, but margin requirements and potential slippage | Active traders with time, technical skills, and risk tolerance | High volatility, leverage magnifies losses; not suited for beginners |

| Holding AUD or Converting USD | Low | Low | High (can be done via bank or online broker) | FX conversion fees (can vary widely), possible opportunity cost | Expats, passive investors looking for stability | Simple, no leverage or complexity; timing still matters |

| Inverse USD ETFs | Low | Medium | Medium (available via global brokers like Interactive Brokers, CMC) | ETF management fees (typically 0.40%–0.75%) | DIY investors wanting indirect USD short exposure | Exposure may be to a basket of currencies vs just AUD |

| AUD-Hedged Global Funds | Low–Medium | Low | High (widely available on ASX and via super platforms) | ETF or fund management fees (0.20%–0.50%) | Long-term investors wanting global diversification without FX risk | Removes USD swings, but may underperform unhedged funds during USD strength |

What Are Some Alternative Ways to Hedge Against USD Weakness?

Not everyone wants to short currencies directly or tinker with ETFs. If you’re like me and prefer strategies that offer a bit more stability — or even growth potential — there are a couple of solid alternatives I’ve leaned on over the years:

Gold: The Traditional Hedge

Gold has been my go-to when I want a defensive hedge. Because it’s priced in US dollars, it often moves in the opposite direction — when the dollar weakens, gold tends to rise. It’s a scarce, tangible asset that people trust during uncertain times. And in my experience, that trust never really goes out of style.

Back in the 2008 financial crisis, and again during the 2020 COVID crash, gold surged as investors pulled out of riskier assets and the US dollar stumbled. I personally saw gold ETFs spike in my portfolio while equities were still catching their breath.

There are a few ways to get into gold:

- Physical gold — bars, coins, etc. (good for peace of mind, but storage can be tricky)

- ETFs like GLD, which are easy to buy and sell

- Gold mining stocks or funds, which can offer leverage to the gold price (but come with more risk)

It’s also great for inflation protection and currency diversification — especially if you already have USD-heavy exposure.

Emerging Markets: A Growth Hedge

Emerging markets are another angle I’ve used when the dollar looked weak. Here’s why: when the USD drops, capital often flows into riskier or higher-growth economies. That usually benefits emerging markets — both their stock markets and their local currencies.

Take Vanguard’s VGE or iShares’ IEM — these are Australian-listed ETFs that give you exposure to places like India, Brazil, and Southeast Asia. When the US dollar retreats, these economies can attract inflows, push up valuations, and strengthen their currencies, giving you a nice tailwind.

But a word of caution: emerging markets come with sovereign risk, currency volatility, and political instability. I always recommend sizing your exposure carefully — this is a growth play, not a safe haven.

Short-Term Income Funds

Short-term income funds are one of the more underrated tools for managing currency exposure while still earning a steady return. I’ve used them in my own portfolio when I wanted lower volatility without sitting entirely in cash. These funds typically invest in high-quality, short-duration bonds — like government or investment-grade corporate debt — usually with maturities under two years. Because of that, they’re less sensitive to interest rate swings, which can help smooth out performance during uncertain market conditions.

For Australian investors who have exposure to USD-denominated income funds, choosing a currency-hedged version can be a smart move. It’s one way to protect returns from exchange rate shocks — especially when the US dollar has been volatile.

Some of the more sophisticated funds even use active currency overlays to manage FX risk, which adds another layer of protection. While these funds won’t directly short the US dollar, I see them as a strategic way to preserve capital and earn income while keeping currency risk in check.

Long-Short Credit Funds

One strategy I’ve found increasingly interesting — especially in more complex or volatile markets — is using long-short credit funds. While these funds aren’t designed specifically for currency trading, they can provide indirect exposure to US dollar trends, particularly when they invest across global credit markets.

Here’s how they work: long-short credit funds aim to generate returns by taking long positions in bonds or credit instruments they believe are undervalued, while shorting those they think are overvalued. This dual approach can help smooth out returns and reduce interest rate risk — but it also opens up opportunities to capitalise on macroeconomic shifts, including movements in the US dollar.

For example, if the fund managers anticipate a weakening USD, they may increase exposure to non-USD-denominated debt or reduce US credit exposure altogether. Some global credit strategies are also currency-hedged or tactically shift exposure based on FX trends — offering another layer of protection or upside, depending on the view.

These funds are best suited for sophisticated investors or those working with financial advisers, as they’re often actively managed, involve derivatives, and can be harder to evaluate at a glance. But in the right portfolio, a well-chosen long-short credit fund can act as both a diversifier and a tactical tool when the US dollar outlook becomes a major theme.

Alternative Methods Compared

| Asset Class | USD Correlation | Volatility | Best For | Typical Access Points | Costs & Fees | Key Considerations |

|---|---|---|---|---|---|---|

| Gold | Inverse (typically moves opposite the USD) | Medium–High | Defensive investors seeking capital protection | Physical bullion, Gold ETFs (e.g., GLD, GOLD.AX), gold mining stocks | 0.30%–0.50% for ETFs; storage costs for physical | Strong historical hedge, but may underperform in calm or rising USD environments |

| Emerging Markets | Inverse / Neutral (often benefits from USD weakness indirectly) | High | Growth-focused investors with global diversification | EM equity ETFs (e.g., VGE, IEM), active EM managed funds | 0.40%–0.80% for ETFs; higher for active funds | High return potential, but sensitive to political risk, currency swings, and global market sentiment |

| Currency-Hedged Funds | Low (designed to neutralise USD exposure) | Low–Medium | Long-term investors seeking global exposure without FX risk | AUD-hedged ETFs and managed funds (e.g., iShares, Vanguard hedged products) | 0.20%–0.50% management fees | Smooths out currency fluctuations, may underperform in strong USD environments |

| Long-Short Credit Funds | Variable (can be positioned for or against USD exposure) | Medium | Tactical investors seeking income with macro flexibility | Active credit hedge funds, institutional bond funds, multi-strategy portfolios | Typically 1%–2% management + performance fees | Complex strategies, often use derivatives; best suited for experienced or advised investors |

Can You Hedge USD Risk Without Making Big Bets?

If you’re not ready to go all-in on shorting the US dollar — and honestly, most people shouldn’t — there are other ways to hedge gradually.

You can get started by converting a portion of USD holdings into AUD, or adding small amounts of AUD-hedged ETFs. That way, there’s no need to time the market perfectly plus, you have the option to just adjust over time as the AUD/USD story evolves.

That said, if you’re dealing with large amounts — particularly inside an SMSF — I strongly recommend talking to a financial adviser or tax specialist. Currency gains, hedging strategies, and cross-border tax rules can get messy quickly, and it’s worth getting it right the first time.

What Should You Watch Out For?

When you are investing in currency-related strategies — whether it’s forex, ETFs, or hedged funds — understanding performance metrics and pricing is essential. I always look beyond the headline returns and dig into historical performance, volatility, and how the product reacts in different market conditions.

I’ve learned the hard way that even when your market thesis is spot on, your execution can make or break your outcome. Here are a few mistakes I see people (myself included) make:

Common Pitfalls

- Overusing leverage — especially in forex — can wipe you out faster than you think.

- Trying to time the market perfectly often leads to missed opportunities…

- Overlooking fees — FX conversion fees, ETF expense ratios, platform charges — they can quietly erode returns over time.

For example, some inverse ETFs may not perfectly mirror USD movements due to compounding effects. Taking the time to evaluate these details helps you choose products that align with your goals and avoid surprises down the track.

Tax and Compliance Considerations

One thing many investors overlook? Currency gains may be taxable, depending on how the asset is structured and where it’s held. And if you’re using offshore ETFs, make sure they’re domiciled appropriately. Some US-domiciled ETFs fall under PFIC rules, which can trigger nasty tax reporting surprises.

Stick with ASIC-regulated brokers or platforms that are transparent about their structures — it’s one less thing to worry about.

Pro Tip: Even if your investment thesis is right, poor execution or hidden costs can kill your returns.

How Can You Get Started?

When I first started managing my exposure to the US dollar, I quickly realised that choosing the right platform made a big difference. If you’re in Australia, we have a list of the best trading platforms to help you get started. I personally look for ones that are AUD-friendly with low FX spreads, so you’re not getting eaten alive by fees every time you trade or convert.

I always recommend starting simple. When I was testing the waters with forex, I used demo accounts to practice before risking real money. It gave me the confidence to understand how things moved without the stress of losing cash. For most investors, starting with ETFs or small AUD conversions is a smart and manageable first step.

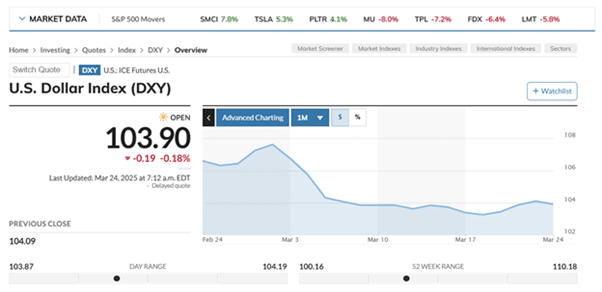

And finally — stay informed. I follow the RBA, keep an eye on the USD Index (DXY), and subscribe to a few economic briefings and currency-focused newsletters. A few minutes a week can really sharpen your perspective.

Final Thoughts

There’s no one-size-fits-all way to short the US dollar, even as a trader in Australia. The right strategy for you depends on your risk tolerance, experience level, and financial goals.

For me, I like to blend my approach — using a mix of hedged ETFs, a little gold, and small currency positions. Gold and emerging markets offer indirect exposure, while forex and inverse ETFs give you more direct control.

The key is to stay diversified and always keep an eye on the big picture.

If you’re unsure, speak with a financial adviser before making any major currency or hedging moves. It’s worth the peace of mind.

FAQs

The safest approach is using AUD-hedged global ETFs or converting some USD into AUD gradually. These methods avoid leverage and minimise risk while still offering currency protection.

Yes, you can short the USD using inverse USD ETFs or by investing in gold and emerging markets, which tend to perform well when the US dollar weakens.

Yes, currency gains can be taxable in Australia, especially if you’re converting large sums or using international ETFs. Always consult a financial adviser or tax specialist.

It can be. Holding AUD is a simple way to reduce USD exposure, especially for expats or those earning in US dollars, but timing and FX fees matter.

Popular platforms include IG, CMC Markets, SelfWealth, Stake, and Saxo. Make sure the platform supports forex, ETFs, or AUD-hedged investments, depending on your strategy.

Buy Bitcoin Today!

- Advanced Security

- AUD Support

- Regulated & Transparent

- Low Fees

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References:

- Reserve Bank of Australia (RBA) – Monetary Policy Statements and AUD Outlook

- U.S. Federal Reserve – Interest Rate Decisions and USD Policy

- Invesco – UDN ETF (Invesco DB US Dollar Index Bearish Fund)

- Vanguard Australia – Vanguard FTSE Emerging Markets Shares ETF (VGE)

- iShares by BlackRock – iShares Core MSCI Emerging Markets ETF (IEM)

- World Gold Council – Gold as a Strategic Asset

- Trading Economics – AUD/USD Exchange Rate, USD Index, Economic Indicators

- Morningstar Australia – ETF and Managed Fund Analysis

- Australian Taxation Office (ATO) – Foreign Currency and Capital Gains Tax Rules

- Reuters / Bloomberg – USD Trends, Fed Announcements, and Global Market Coverage

Our #1 Rated Bitcoin Trading Platform

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.