Best Crypto Exchanges in Australia for 2025

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

General Disclaimer

Cryptocurrency trading involves significant risks, including the potential loss of your entire investment. Prices can be highly volatile, and past performance is not indicative of future results. Please consider your financial situation, risk tolerance, and seek independent financial advice before engaging in cryptocurrency trading.

Affiliate Disclosure

This page contains affiliate links, meaning we may earn a commission if you click through and sign up with one of our partners. This does not influence our reviews or rankings, which are based on our honest opinions and thorough research.

Updated 02/04/2025

Explore our trusted crypto exchanges, tested with real trades and tailored for Australians, offering seamless AUD transactions and top security.

Quick Answer: What's the Best Crypto Exchange in Australia?

eToro is the best crypto exchange for Australians in 2025, offering a user-friendly interface, excellent security, and innovative social trading features like copy trading. For advanced traders, Kraken provides top-tier tools and high liquidity, while Coinbase remains the go-to for beginners seeking simplicity and security.

Featured Exchange - eToro

- Advanced Security

- AUD Support

- Regulated & Transparent

- Low Fees

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Here Are the 7 Best Crypto Exchanges in Australia for 2025

After testing various platforms, here are the 7 best crypto exchanges for Australians in 2025. These exchanges excel in security, low fees, and user experience, catering to everyone from beginners to advanced traders. Let’s dive into what makes each one unique.

- eToro – Best for Social Trading and Copy Trading

- Kraken – Advanced Features and High Liquidity

- Coinbase – Beginner-Friendly and Highly Secure

- Crypto.com – Best for Rewards and Crypto Variety

- CoinJar – Australian-Made and Easy to Use

- OKX – Low Fees and Advanced Tools

- Swyftx – Affordable and Easy to Use

How Do These Exchanges Compare?

When comparing crypto exchanges, Australians should consider fees, features, security, and suitability for their trading goals. Below is a summary of how the top platforms stack up.

| Platform | Trading Fees | AUD Deposit Fees | Key Feature | Security Features | Best For |

|---|---|---|---|---|---|

| eToro | Spread (from 0.75%) | $0 | Social trading and copy trading | Regulated, 2FA, cold storage | Beginners, Long-term investors |

| Kraken | 0.16%-0.26% | $0 | Advanced tools, high liquidity | Cold storage, audits, 2FA | Active traders, Advanced users |

| Coinbase | ~1.49% | $0 | Beginner-friendly | Insured, 2FA, cold storage | Beginners, Security-conscious users |

| Crypto.com | Low/zero for some trades | Varies | Crypto rewards and variety | Secure cold storage | Staking enthusiasts, Rewards users |

| CoinJar | Transparent pricing | $0 | Australian-made, easy to use | 2FA, AUSTRAC-compliant | Australian-focused traders |

| OKX | 0.10% | Low fees | Advanced tools, low fees | Cold storage, strong encryption | Altcoin enthusiasts |

| Swyftx | Transparent (0.6%-1.0%) | $0 | Affordable, user-friendly | Local support, encryption | Beginners, Australian users |

7 Best Crypto Exchanges

#1 eToro – Best for Social Trading and Copy Trading

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro is my top pick because it makes crypto trading accessible to everyone, especially beginners. Its social trading feature lets you copy strategies from experienced traders, which I’ve found incredibly useful.

Pros & Cons

- Easy-to-use interface for beginners.

- Social trading to follow top-performing traders.

- Limited cryptocurrency options compared to others.

- Spreads can be higher for less popular coins.

What are the Fees?

- Spreads: Fees range from 0.75% for Bitcoin to higher percentages for altcoins.

- Deposit Fee: $0 for AUD.

- Withdrawal Fee: $5.

What Cryptocurrencies are Available?

eToro supports over 75 cryptocurrencies, including popular ones like Bitcoin (BTC), Ethereum (ETH), and XRP. While it lacks niche altcoins, it covers most traders’ needs.

How Safe is the Exchange?

eToro is AUSTRAC-registered, complies with strict regulations, and uses advanced encryption for transactions. Funds are stored in tier-1 banks, and user accounts are protected by two-factor authentication (2FA).

KYC Requirements

eToro requires a government-issued ID (passport or driver’s licence) and proof of address, such as a utility bill or bank statement. The process is straightforward and takes less than 24 hours.

User Reviews and Feedback

Users love the clean interface and social trading features. Beginners say it’s one of the easiest platforms to start with. On the flip side, more experienced traders often complain about the limited coin selection and wider spreads compared to other platforms.

#2 Kraken – Advanced Features and High Liquidity

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Kraken is ideal for advanced traders like me who value features such as margin trading and futures. It also offers exceptional liquidity for high-volume transactions.

Pros & Cons

- Extensive crypto options for advanced users.

- Excellent tools for margin trading.

- Not as beginner-friendly as other platforms.

- Interface can feel overwhelming at first.

What are the Fees?

- Trading Fees: 0.16% maker and 0.26% taker (discounted for higher volumes).

- Deposit Fee: Free for AUD.

- Withdrawal Fee: Varies by cryptocurrency.

What Cryptocurrencies are Available?

With over 185 cryptocurrencies, Kraken supports both major coins like Bitcoin and niche altcoins like Kusama (KSM). It’s perfect for those seeking variety.

How Safe is the Exchange?

Kraken prioritises security with cold storage for funds, regular audits, and two-factor authentication. I’ve always felt confident leaving funds on the platform.

KYC Requirements

Kraken requires identity verification through ID documents and proof of residence. Enhanced verification levels allow access to more features, such as higher withdrawal limits.

User Reviews and Feedback

Long-time users praise Kraken’s reliability and security, especially for large trades. However, some newer users say the interface feels “too complex” for a first-time experience. High marks for customer support responsiveness.

#3 Coinbase – Beginner-Friendly and Highly Secure

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

When I first started trading, Coinbase was my go-to platform. Its simplicity and security make it an excellent choice for beginners.

Pros & Cons

- Intuitive platform perfect for first-time traders.

- Highly secure with insurance coverage for assets.

- Higher fees compared to other platforms.

- Limited features for advanced traders.

What are the Fees?

- Trading Fees: Around 1.49% for standard transactions.

- Deposit Fee: Free for bank transfers.

- Withdrawal Fee: Up to 1% depending on the payment method.

What Cryptocurrencies are Available?

Coinbase offers over 150 coins, including Bitcoin, Ethereum, and Solana (SOL). While it doesn’t support some niche tokens, it’s more than enough for casual traders.

How Safe is the Exchange?

Coinbase is regulated and insured, with 98% of funds stored in cold storage. I appreciate their commitment to security, especially for beginners.

KYC Requirements

Coinbase asks for ID verification and proof of address. The process is fast, and I completed it within an hour.

User Reviews and Feedback

Coinbase is consistently praised by beginners for its simplicity and safety. However, seasoned traders often complain about the steep fees and lack of features. Mobile app performance and user experience get solid marks across the board.

- Wide range of cryptocurrencies.

- Cashback crypto cards and staking rewards.

- Interface may feel complex for beginners.

- Withdrawal fees can be high for some coins.

- Trading Fees: Tiered fees starting at 0.10%, with discounts for CRO token holders.

- Deposit Fee: Free for AUD deposits via bank transfer or PayID.

- Withdrawal Fee: Varies by cryptocurrency (e.g., 0.0004 BTC for Bitcoin).

#4 Crypto.com – Best for Rewards and Crypto Variety

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Crypto.com is a well-rounded platform offering diverse cryptocurrencies and exceptional rewards programs. I personally enjoy their cashback crypto cards and staking options for earning passive income.

Pros & Cons

- Wide range of cryptocurrencies.

- Cashback crypto cards and staking rewards.

- Interface may feel complex for beginners.

- Withdrawal fees can be high for some coins.

What are the Fees?

- Trading Fees: Tiered fees starting at 0.10%, with discounts for CRO token holders.

- Deposit Fee: Free for AUD deposits via bank transfer or PayID.

- Withdrawal Fee: Varies by cryptocurrency (e.g., 0.0004 BTC for Bitcoin).

What Cryptocurrencies are Available?

With over 250 supported cryptocurrencies, Crypto.com offers everything from Bitcoin and Ethereum to niche altcoins like VET and KAVA. It’s ideal for those seeking variety.

How Safe is the Exchange?

Crypto.com takes security seriously, using cold storage for most funds, two-factor authentication, and insurance coverage of up to $750 million for user assets.

KYC Requirements

Crypto.com requires you to verify your identity by submitting a valid government-issued ID and a selfie. The process is simple and typically completed within 24 hours.

User Reviews and Feedback

Users love the Crypto.com card and the ability to earn yield on holdings. That said, some complain the app can feel cluttered and that withdrawal fees are too high for certain tokens. Support is generally responsive but could be faster.

- Australian-focused platform with AUD support.

- Free AUD deposits and withdrawals.

- Fewer cryptocurrencies compared to larger platforms.

- Trading fees start at 1%, higher than some platforms.

- Trading Fees: Transparent fees starting at 1%.

- Deposit Fee: Free for AUD deposits via PayID or BPAY.

- Withdrawal Fee: Free for AUD bank withdrawals.

#5 CoinJar – AUS Made and Easy to Use

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

CoinJar is an Australian-made platform that offers a simple and seamless experience for local traders. Its support for AUD deposits and withdrawals makes it particularly appealing.

Pros & Cons

- Australian-focused platform with AUD support.

- Free AUD deposits and withdrawals.

- Fewer cryptocurrencies compared to larger platforms.

- Trading fees start at 1%, higher than some platforms.

What are the Fees?

- Trading Fees: Transparent fees starting at 1%.

- Deposit Fee: Free for AUD deposits via PayID or BPAY.

- Withdrawal Fee: Free for AUD bank withdrawals.

What Cryptocurrencies are Available?

CoinJar supports 50+ cryptocurrencies, including major coins like Bitcoin, Ethereum, and Litecoin. While its offerings are limited compared to larger platforms, it covers popular options.

How Safe is the Exchange?

As an AUSTRAC-registered exchange, CoinJar complies with local regulations and employs robust security measures, such as two-factor authentication and secure asset storage.

KYC Requirements

CoinJar requires standard KYC checks, including a government-issued ID and proof of address. The process is tailored for Australian users and is typically completed quickly.

User Reviews and Feedback

Users love that CoinJar is Aussie-focused and easy to use. It gets high praise for its mobile app and reliable AUD transactions. Advanced traders may feel it lacks features and depth, especially when it comes to altcoin options.

#6 OKX – Low Fees and Advanced Tools

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

OKX is a platform I recommend for advanced traders seeking low fees and powerful trading tools. Its wide cryptocurrency offerings are also a huge draw.

Pros & Cons

- Low trading fees and high-volume discounts.

- Advanced trading tools for professionals.

- AUD deposits require third-party providers.

- Interface is geared towards experienced traders.

What are the Fees?

- Trading Fees: Starts at 0.10% for spot trading, with discounts for high-volume traders.

- Deposit Fee: Free for AUD via crypto wallets or third-party providers.

- Withdrawal Fee: Varies by asset (e.g., 0.0005 BTC for Bitcoin).

What Cryptocurrencies are Available?

OKX supports 350+ cryptocurrencies, including major coins, altcoins, and tokens for DeFi and NFTs. It’s a great platform for exploring emerging assets.

How Safe is the Exchange?

OKX uses advanced security protocols, including multi-signature wallets, cold storage, and real-time monitoring. These features provide peace of mind for traders.

KYC Requirements

To unlock full features, OKX requires identity verification using a government-issued ID and a photo. The process is smooth and typically completed within a day.

User Reviews and Feedback

Users like the depth of features and low fees. That said, newcomers report struggles navigating the interface. OKX scores well among power users, but beginners should approach with caution.

#7 Swyftx – Affordable and Easy to Use

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Swyftx is an Australian favourite for its low fees, easy-to-use interface, and excellent customer support. It’s a great starting point for anyone new to crypto.

Pros & Cons

- Transparent fees and AUD support.

- Local Australian customer support.

- Lacks advanced trading tools.

- Limited international market access.

What are the Fees?

- Trading Fees: Transparent, ranging from 0.6% to 1.0%.

- Deposit Fee: Free for AUD via PayID or bank transfer.

- Withdrawal Fee: Free for AUD withdrawals.

What Cryptocurrencies are Available?

Swyftx supports over 300 cryptocurrencies, including Bitcoin, Ethereum, and various altcoins. Its range caters to both beginners and seasoned investors.

How Safe is the Exchange?

Swyftx complies with AUSTRAC regulations and uses advanced encryption to protect user data. I also appreciate the platform’s transparency regarding security protocols.

KYC Requirements

Swyftx’s verification process is tailored for Australian users, requiring ID and proof of address. I found it quick and hassle-free.

User Reviews and Feedback

Swyftx gets solid reviews for being intuitive, transparent, and locally tailored. Users appreciate its demo mode and live chat. A few users mention minor delays in AUD withdrawals, but overall satisfaction is high.

What is a Crypto Exchange?

When I first got into crypto, I quickly realised that a crypto exchange is where it all happens. It’s basically a digital marketplace where you can buy, sell, and trade cryptocurrencies like Bitcoin and Ethereum. Think of it like a stock exchange—but for crypto. Most exchanges in Australia also support AUD transactions, which has made my experience smoother and way more cost-effective than using overseas platforms.

Why Use a Crypto Exchange in Australia?

For me, crypto exchanges are essential tools. They give me easy access to the digital assets I want to buy or trade, and they let me manage everything in Australian dollars. No messy conversions, no hidden fees—just direct access to crypto markets, all from my phone or laptop.

Low Fees for AUD Transactions

One of the biggest perks? No currency conversion worries. Platforms like CoinJar and Swyftx allow me to deposit AUD directly through PayID or bank transfers, which keeps my fees low. I’ve genuinely saved hundreds over the years by avoiding international transaction fees and trading directly in AUD.

Access to a Wide Range of Cryptocurrencies

I’m someone who likes to explore beyond just Bitcoin and Ethereum. Exchanges like Kraken and Crypto.com give me access to hundreds of coins—including niche altcoins that I wouldn’t find on smaller platforms. This has allowed me to diversify and take positions in projects I believe in early on.

Ease of Use for Australian Traders

When I was starting out, I was honestly nervous. But Swyftx made the process feel easy. The layout was clean, everything was in plain English, and deposits showed up quickly. The fact that it’s built with Aussie users in mind—including local support—gave me the confidence to dive in without feeling overwhelmed.

Crypto Exchange Comparison Australia

| Exchange | User Satisfaction | Supported Cryptos | Deposit Methods | KYC Process | AUD Support |

|---|---|---|---|---|---|

| eToro | High (great for beginners, popular social features) | 75+ | Bank, Card | Fast (<24h), ID & address | Yes |

| Kraken | High (trusted by advanced users, secure) | 185+ | Bank Transfer | Multi-level, ID & address | Yes |

| Coinbase | High for beginners (simple UI), Mixed for advanced | 150+ | Bank Transfer | Quick (<1h), ID & address | Yes |

| Crypto.com | High (rewards and variety), Mixed UI experience | 250+ | Bank, PayID | Full ID, photo | Yes |

| CoinJar | Good (AUS local support, simple UI) | 50+ | PayID, BPAY | Fast, ID & address | Yes |

| OKX | Mixed (great for pros, difficult for beginners) | 350+ | Crypto, Third-party AUD | Photo + ID | Via third-party |

As you can see the table highlights the fact that eToro, Swyftx, and Coinbase are best suited for beginners due to their simple interfaces and fast KYC processes.

Kraken and OKX appeal more to advanced traders with lower fees and powerful trading tools, though their platforms may be less intuitive.

Crypto.com stands out for its rewards and coin variety, while CoinJar offers a locally-focused experience with strong AUD support.

All listed exchanges support AUD deposits, but only OKX requires third-party providers, which could be a drawback for some users.

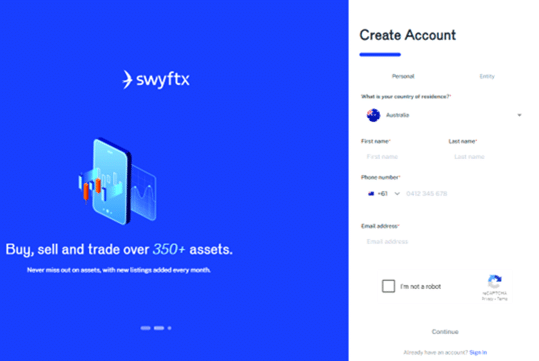

How to Open an Exchange Account in Australia: Step-by-Step

Setting up a cryptocurrency exchange account in Australia is a fairly simple process, but it does involve a few steps to comply with Australian financial regulations. Here’s a quick step-by-step guide:

1. Choose a Registered Exchange

Start by selecting a crypto exchange that is registered with AUSTRAC, the local financial authority. Make sure the exchange complies with Australian financial regulations and has a good reputation.

2. Sign Up for an Account

Visit the exchange’s website or app and click “Sign Up” or “Create Account.”

You’ll need to enter basic details such as:

- Full name

- Email address

- Phone number

- Password (make it strong!)

Once done, you’ll typically get a confirmation email or SMS code to activate your account.

3. Complete Identity Verification (KYC)

In Australia, all exchanges must follow KYC verification rules. This means you’ll need to verify your identity before you can trade.

Upload the following documents:

- A government-issued identification (e.g., passport or driver’s license)

- A selfie or short video (for manual verification, if required)

This identity verification is part of the exchange’s due diligence process to meet AML/CTF obligations.

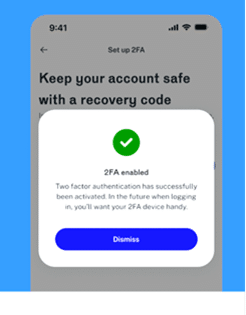

4. Set Up Authentication

Enable two-factor authentication (2FA) as part of the authentication process. This step adds a layer of protection for your account using an app like Google Authenticator or Authy.

5. Choose a Deposit Method

You can fund your account using:

- Bank transfer (usually free and fast for local AUD deposits)

- Credit/debit cards (may involve higher fees)

- POLi, PayID, or other deposit options depending on the exchange

Make sure your payment method is in your name—exchanges often reject third-party transfers.

6. Start Trading and Using the Exchange Wallet

Once your funds land, you’re ready to buy crypto. The exchange will store your assets in an exchange wallet, which is fine for beginners.

Pro Tip: For larger amounts, consider transferring to a private wallet for added security.

Factors to Consider When Choosing a Crypto Exchange in Australia

After years of navigating the crypto space, I’ve figured out that not all exchanges are created equal. Choosing the right one can really make or break your trading experience—especially here in Australia, where AUD support, regulation, and ease of use vary from platform to platform. Here’s what I personally look for:

Security

Security is always my top priority. I’ve seen too many stories of hacks and security breaches to take this lightly. I always choose exchanges with strong features like cold storage, two-factor authentication (2FA), and clear insurance policies. From my own experience, Kraken and Swyftx are rock solid—they’ve given me peace of mind when leaving funds on the platform, even overnight.

Fees

Fees can eat into your profits fast. That’s why I stick with platforms like OKX and Kraken, which are super transparent about their fee structures. I always compare the trading fees, deposit fees, and withdrawal fees before signing up. Over time, those little savings really add up—especially if you’re trading frequently.

User Experience

The interface matters more than you’d think. When I was just getting started, Coinbase and Swyftx stood out for their beginner-friendly layouts. Everything just made sense. These days, I lean toward more advanced platforms like Kraken for their charting tools and order types—but if you’re new to trading crypto, simplicity is your friend.

Market Variety

I like to explore different coins—not just Bitcoin and Ethereum. So I prefer exchanges like Crypto.com and OKX, which offer hundreds of coins, including a bunch of niche altcoins I can’t find elsewhere. It’s a great way to diversify and spot early opportunities.

Customer Support

Reliable customer support is invaluable, especially when troubleshooting account or transaction issues. Platforms with 24/7 assistance, such as Swyftx and Kraken, have proven helpful in my experience, ensuring timely resolution of queries.

By evaluating these factors, you can confidently select a crypto exchange that aligns with your trading preferences while prioritising security, usability, and regulatory compliance in Australia.

In short, when I evaluate a crypto exchange, I’m not just looking at the surface. I dig into the security features, fee transparency, coin selection, and support quality—because those are the things that really matter when your money’s on the line.

Additional Considerations for Australian Users

As someone who’s been trading crypto in Australia for a while now, I’ve learned that there are a few uniquely Australian challenges to navigate—especially when it comes to tax and regulation. These aren’t things you want to overlook if you want to trade with confidence and avoid surprises at tax time.

Taxes & Legal Considerations: What I’ve Learned as an Aussie Crypto Trader

When I first started trading crypto, I didn’t realise how closely the Australian Taxation Office (ATO) was watching. In Australia, crypto isn’t considered fiat currency—it’s treated as property, which means it’s subject to capital gains tax (CGT). Every time I sell, swap, or even spend crypto, it can trigger a CGT event. That includes airdrops and staking rewards, which are usually treated as business income or personal income, depending on how you’re using them.

To stay on top of this, I’ve used crypto tax software. These tools connect directly to exchanges and wallets, making it way easier to track every trade and generate reports for tax time. Some platforms like Swyftx also let me export my transaction history, which helps a bunch when it comes to compliance.

Legally, exchanges in Australia must register with AUSTRAC and follow anti-money laundering and counter-terrorism financing laws. That’s why you’ll go through ID checks and verification—it’s not just red tape, it’s regulation. As someone who wants to stay compliant and avoid stress during tax season, I’ve learned that good record-keeping and the right tools make all the difference.

Regulatory Environment

I also pay close attention to the regulatory environment here in Australia. Exchanges have to register with AUSTRAC and follow strict anti-money laundering (AML) and counter-terrorism financing (CTF) rules. That’s why you’ll always go through identity checks when signing up to a new exchange—it’s part of the law. I actually feel more comfortable knowing that the platforms I use are regulated locally. There’s also talk of new legislation that could bring more consumer protection and clarity, which I think is a good thing in the long run.

What are the risks of using a Crypto Exchanges?

Using cryptocurrency exchanges comes with several risks that traders should be aware of. Security breaches and phishing scams are ongoing threats, especially on platforms that lack robust user protections. Some exchanges have suffered bankruptcies or liquidity crises, leaving users unable to access their funds.

Additionally, leverage trading can amplify losses during volatile markets, while price slippage and high network fees can eat into profits. On the regulatory side, users may face AML breaches, bank transaction blocks, or challenges with capital gains reporting to the Australian Taxation Office.

To reduce exposure, many traders use hardware wallets or non-custodial wallets to store assets securely off-exchange.

Conclusion

Crypto trading in Australia has come a long way, and I’ve really enjoyed being part of the journey. Whether you’re after low fees, a wide range of coins, or just a user-friendly experience, there’s a platform out there that suits your goals. For me, the key has been to focus on security, stay compliant with local laws, and keep an eye on trading fees. Start small, do your homework, and most importantly—enjoy the ride. The crypto space is fast-moving, but if you stay informed, there’s a lot of opportunity out there.

FAQs

Fees vary depending on the platform. eToro charges spreads, Kraken offers low trading fees, and CoinJar provides competitive AUD deposit fees. Always review hidden costs like withdrawal fees, which can add up over time.

Yes, crypto trading is legal in Australia. Exchanges must comply with AUSTRAC regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, ensuring a secure trading environment for users.

You can deposit AUD via bank transfer, PayID, POLi, or debit/credit card. Platforms like eToro, CoinJar, and Swyftx support instant AUD deposits, making it easy for Australians to start trading quickly.

Reputable exchanges like CoinJar and Swyftx are secure. They utilise advanced encryption, store funds in cold storage, and comply with Australian regulations to ensure high safety standards for traders.

Some platforms, like OKX and Crypto.com, offer low or zero trading fees for specific transactions. Always check the fee structure and terms to find the best deal for your trading needs.

Top 5 Exchanges

1

eToro

51% of retail investor accounts lose money when trading CFDs with this provider.

2

Kraken

Capital is at Risk!

3

Coinbase

Capital is at Risk!

4

Crypto.com

Capital is at Risk!

5

CoinJar

Capital is at Risk!

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References:

- AUSTRAC – Digital Currency Exchange Registration

(Official regulatory body for crypto exchanges in Australia) - ASIC – Australian Securities and Investments Commission

(Info on crypto-related financial services, enforcement actions, and consumer warnings) - Kraken – Kraken Security Documentation

(Details on Kraken’s cold storage, MFA, and security practices) - Swyftx Support – KYC, Security & Fees

(Australian exchange-specific verification and operational info) - CoinSpot Help Centre – Account Security

(Security best practices and FAQs on trading in Australia) - Crypto.com – Exchange & App FAQ

(Details on fees, supported currencies, and user protections)

Our #1 Rated Crypto Exchange

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.