How to Short Tesla Stock in Australia | 2025

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

General Disclaimer

Cryptocurrency trading involves significant risks, including the potential loss of your entire investment. Prices can be highly volatile, and past performance is not indicative of future results. Please consider your financial situation, risk tolerance, and seek independent financial advice before engaging in cryptocurrency trading.

Affiliate Disclosure

This page contains affiliate links, meaning we may earn a commission if you click through and sign up with one of our partners. This does not influence our reviews or rankings, which are based on our honest opinions and thorough research.

Updated 02/04/2025

Quick Answer: How to Short Tesla in Australia

To short Tesla in Australia, use CFDs, put options, or U.S. inverse ETFs. CFDs suit short-term traders, while options define risk. Inverse ETFs are simplest for beginners. All carry risk, so use stop-losses and manage leverage carefully. Learn strategies and tools in this guide.

Featured Platform - eToro

- Advanced Security

- AUD Support

- Regulated & Transparent

- Low Fees

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What Does It Mean to Short Tesla Stock?

Shorting stocks can sound intimidating if you’re new to the markets. The idea of betting against a stock can feel a little backwards. But once you get the hang of it, you’ll realise short selling is just another strategy — a risky one, yes, but also a legitimate tool in the right hands.

In simple terms, short selling lets you profit when a stock falls in value. Instead of buying low and selling high, you flip the script: you sell high first, then aim to buy back lower. You typically borrow shares from your broker, sell them at the current price, then buy them back later (hopefully at a discount). Your profit is the difference between those two prices. Of course, if the price rises instead of falling… you’re in hot water.

This strategy is high risk — but it plays a key role in financial markets. Short selling adds liquidity and helps identify overvalued stocks, forcing companies and investors to stay honest. I’ve personally used short selling to hedge risk and capitalise on overhyped stocks.

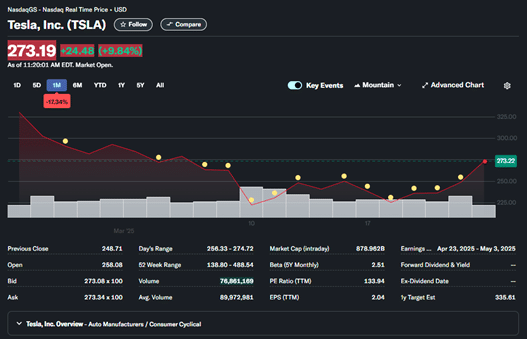

So, Why Tesla?

Tesla (TSLA) is one of the most talked-about stocks in the world. It is volatile, headline-driven, and often trades more on sentiment than fundamentals. Tweets from Elon Musk, earnings surprises, or shifts in market mood can move the price dramatically — sometimes by 5–10% in a single day.

That volatility makes Tesla a prime candidate for short sellers — especially those who believe its valuation has outpaced its earnings potential. I’ve shorted Tesla in the past, and I can tell you from experience: it’s not a casual trade. You need a plan, discipline, and a deep understanding of risk.

Can Australians Short Tesla Stock – and If So, How?

Yes, absolutely — Australian investors can short Tesla. TSLA is listed on the NASDAQ in the U.S., not the ASX. That means you won’t find it through most traditional Australian share trading accounts.

Short Selling on the ASX

Short selling on the Australian Securities Exchange (ASX) works a little differently than shorting overseas stocks like Tesla. To short sell ASX-listed companies, you typically need access to a margin lending facility or a broker that allows borrow-and-sell arrangements, such as Interactive Brokers.

Not all ASX stocks are shortable, so you’ll need to check availability with your platform. While CFDs are also an option for ASX shorting, they come with their own risks, including leverage and overnight financing fees.

With the rise of international trading platforms, Aussies can now access U.S. markets fairly easily.

There are two main methods to short Tesla:

- CFDs (Contracts for Difference) – Best for short-term traders. You don’t own the stock — you’re trading a contract based on its price. You can profit from falling prices using leverage.

- Options – More advanced, but they give you the flexibility to structure trades with defined risk and fixed expiry dates.

Both tools have pros and cons, which I’ll dive into shortly.

Which Brokers Let Australians Short Tesla?

If you’re looking to short Tesla from Australia, here are the brokers I’ve used and can recommend based on experience:

- IG Markets – Great for CFD trading. User-friendly, ASIC-regulated, and packed with risk management features like guaranteed stop-losses.

- CMC Markets – Another solid CFD broker. I like their advanced charting tools and fast execution.

- Interactive Brokers – My go-to for options trading. Low fees, access to U.S. markets, and a robust platform. Just be ready for a steeper learning curve.

- Saxo Markets – Also strong for options. More suited to experienced traders. Higher fees, but excellent global access.

All of these brokers are ASIC-regulated, which gives me confidence that they’re operating within Australian standards. If you’re dealing with leverage or complex instruments, this regulatory oversight is a must.

What should I look out for Shorting Tesla Stock?

Before I short any stock — especially one as volatile as Tesla — I always start with a solid market analysis. I look for signs that a stock may be overextended or trading well above its fundamental value. For me, that includes reviewing valuation metrics like price-to-earnings (P/E) ratios, watching for slowing revenue growth, and noting any negative sentiment shifts in the news or on earnings calls. I also pay close attention to technical indicators, such as overbought RSI levels or failed breakouts. A good short candidate often shows signs of excessive hype, weak fundamentals, high short interest, and limited near-term catalysts for growth. Tesla frequently ticks these boxes — which is why it’s been on my radar so often.

What’s the Easiest Way to Short Tesla? (Using CFDs)

In my opinion, CFDs are the easiest way for most Aussie retail traders to short Tesla. I have tried some of the best CFD brokers in Australia over the years, especially for quick trades based on news, momentum, or earnings.

CFDs let you speculate on Tesla’s price without owning the shares. When you open a “Sell” CFD position, you’re betting the price will fall. If it does, you profit. If it rises, you lose — and since you’re using leverage, those losses can add up fast.

Step-by-Step: How I Short Tesla Using CFDs

- Choose a CFD broker – I use IG or CMC. Both are reliable and user-friendly.

- Fund your account and search for Tesla (TSLA).

- Open a ‘Sell’ position – This means you’re going short. You can also set a stop-loss and take-profit order.

- Manage your margin and position – Watch your margin level. If the stock moves against you, you may face a margin call.

What are Common Mistakes to avoid?

- Ignoring overnight fees – Holding positions overnight costs money. Those fees eat into your profits.

- Overleveraging – Just because you can trade big doesn’t mean you should.

- No stop-loss – Always have an exit plan. A 5% move in Tesla can wreck an unprotected CFD position.

Can I Short Tesla Using Options? (Advanced Strategy)

Options aren’t for beginners, but they’re my preferred tool when I want to short Tesla with defined risk.

The basic play here is to use the best options broker to buy a put option. A put gives you the right (not obligation) to sell Tesla shares at a certain price before the option expires. If the stock drops below that strike price, your option increases in value.

Example – Buying a Tesla Put Option

Let’s say I buy a put option with a $700 strike, paying a $30 premium, expiring in one month.

- If Tesla drops to $650, I can sell it at $700.

- That’s a $50 gain minus the $30 premium = $20 profit per share.

I like this setup because the maximum loss is capped — I can’t lose more than the premium I paid.

Using a Bear Put Spread

To reduce the cost of the trade, I sometimes use a bear put spread:

- Buy a $700 put, sell a $650 put, same expiry.

- Limits profit to $50 per share (minus net cost), but reduces the upfront premium.

For example, if I pay $15 for the spread and Tesla drops below $650, I’d make $35 per share.

CFDs vs Options – Which Is Better for Shorting Tesla?

Each tool has its place. Here’s a quick breakdown:

CFDs vs Options for Shorting Tesla

| Feature | CFDs (Contracts for Difference) | Options (Put Options & Spreads) |

|---|---|---|

| Leverage Available | Yes. Leverage typically ranges from 5:1 to 20:1 for retail traders, depending on the broker. | Yes. Leverage is built into the instrument — premium paid controls a larger position. |

| Expiry | No expiry. You can hold a position indefinitely, as long as you meet margin requirements. | Yes. Options have a fixed expiry date — typically weekly, monthly, or quarterly. |

| Risk | High. Losses can be unlimited if no stop-loss is in place. Liquidation risk if margin runs out. | High, but predefined if you're buying puts. Selling options introduces more risk. |

| Capital Required | Moderate. You only need to fund the margin, but leverage magnifies both gains and losses. | Lower if buying single puts or using spreads. Still requires cash to cover premiums. |

| Ideal Use Case | Best for short-term trades where quick execution and flexibility are key. | Better for structured trades with a thesis, or as a hedge against existing positions. |

| Execution Complexity | Simple execution via most CFD platforms — more beginner-friendly. | Requires understanding of strikes, expiry, and option greeks — better for experienced traders. |

| Cost Considerations | May incur overnight financing fees, spreads, and slippage. | Upfront premium cost. Can lose 100% of premium if the trade doesn’t play out. |

| Access for Aussies | ✅ Widely available through ASIC-regulated brokers (e.g. IG, CMC). | ✅ Available via international brokers (e.g. Interactive Brokers, Saxo), but more setup required. |

I like to think of CFDs as the “instant reaction” tool, and options as the “chess move” — both have their place, depending on your market view and strategy.

Pros and Cons of Shorting Tesla

Like any strategy, shorting comes with pros and cons. Tesla in particular has a reputation for turning on short sellers — so tread carefully.

Pros vs Cons of Shorting Tesla

| Pros | Cons | |

|---|---|---|

| Profit from falling markets | Potential for unlimited losses – If Tesla’s price spikes, especially with CFDs, losses can exceed your initial investment if stop-losses aren’t in place. | |

| Flexible tools to hedge or speculate | Requires constant monitoring – Tesla is volatile. You’ll need to keep an eye on your positions, especially when using leverage. | |

| Global market access via brokers | Emotional stress & fast market moves – Tesla is a favourite among retail investors, and price action can be irrational or news-driven. | |

| Leverage amplifies gains | Leverage also amplifies losses – What makes it profitable can also make it dangerous. Moves against your position are magnified. | |

| Defined risk with options | Time-sensitive strategies – Options expire. If Tesla doesn’t move in your favour quickly enough, you could lose the entire premium. | |

| Can be used as a hedge | Short squeezes are real – Tesla has been the target of multiple short squeezes, leading to sharp, sudden price spikes. | |

| Access to diversified short exposure via ETFs | Tax and FX complexity – Gains or losses from shorting U.S. stocks may trigger capital gains tax, and AUD/USD conversion adds another layer. |

When I first started shorting, I underestimated the emotional side — watching a stock like Tesla rally 10% in a day can really test your conviction. That’s why I always stress risk management and mental discipline just as much as technical skill.

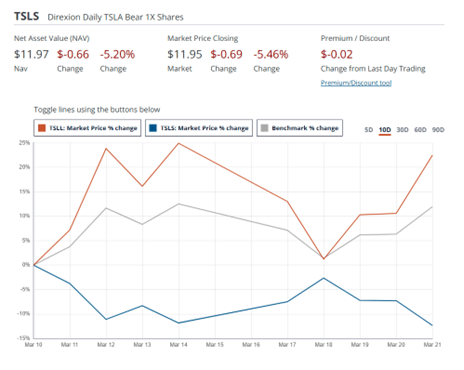

Are There Other Ways to Bet Against Tesla?

Yes — and they’re much simpler.

If you’re looking for low-effort ways to short Tesla, consider inverse ETFs. These funds go up when Tesla (or tech) goes down. You can buy and sell them like regular shares.

- TSLS and TSLQ are U.S.-listed ETFs that short Tesla specifically.

- Broader funds like SQQQ or PSQ short the NASDAQ index.

They’re ideal if you want bearish exposure without using leverage. But you’ll still need a broker with access to U.S. markets (like Interactive Brokers or Saxo).

What is Short Interest and Short Squeezes?

Short interest measures how many shares have been shorted but not yet covered. High short interest tells me a lot of traders are betting against the stock — which can be useful info.

But there’s a twist: when prices start rising, short sellers may panic and buy back their positions to cut losses. That rush of buying causes a short squeeze, driving prices up even faster.

Tesla has been at the centre of multiple short squeezes. I’ve watched trades get obliterated in hours because too many people were short at the wrong time. If you’re shorting Tesla, always monitor short interest — and have a quick exit plan.

The Biggest Risks of Shorting Tesla

Here’s the thing — shorting Tesla is not for beginners.

- Volatility – It’s not unusual for Tesla to move 10% in a day.

- Leverage – Works great when you’re right, and terribly when you’re wrong.

- Short squeezes – Momentum shifts can wipe out positions fast.

- Time decay – For options traders, this eats your premium everyday.

- Tax and forex – U.S. trades can trigger capital gains tax and AUD/USD conversion issues.

I’ve seen promising trades turn ugly because the market mood flipped. Never short more than you can afford to lose.

Final Thoughts: Should I short Tesla Stock?

Shorting Tesla isn’t for everyone — and that’s okay.

If you’re new to this, start small, use demo accounts, and treat any real capital as risk capital. I always:

- Set tight stop-losses

- Use small position sizes

- Avoid overleveraging

- Keep a cool head when the market moves

Tesla can move fast, and so should your risk management. Get educated, test your strategies, and only trade what you’re comfortable losing.

With the right tools and discipline, shorting Tesla can be part of a smart, balanced trading approach.

FAQs

No, Tesla isn’t listed on the ASX—it trades on the U.S. NASDAQ. However, Aussie investors can short Tesla by using international brokers that offer access to U.S. markets through CFDs, options, or inverse ETFs.

There’s no “safe” way to short any stock, but using put options or bear put spreads can limit your losses to the upfront premium. These strategies offer predefined risk, unlike CFDs, which can lead to unlimited losses if unmanaged.

Popular platforms include IG Markets and CMC Markets for CFDs, and Interactive Brokers or Saxo Markets for options trading. All are ASIC-regulated and offer access to U.S. shares like Tesla.

Not necessarily. CFDs and options allow you to use leverage or smaller position sizes, making them accessible with lower upfront capital. Just remember: less capital doesn’t mean less risk—leverage magnifies both gains and losses.

Yes, you can invest in inverse ETFs like TSLS or TSLQ, which rise when Tesla falls. You can also use broader tech or NASDAQ-short ETFs for indirect bearish exposure. These are easier to manage but less targeted.

Buy Bitcoin Today!

- Advanced Security

- AUD Support

- Regulated & Transparent

- Low Fees

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References:

- ASIC – Australian Securities & Investments Commission

“Trading in Contracts for Difference (CFDs).” - IG Markets Australia

“Tesla Share Price – TSLA CFD Trading.” - Interactive Brokers Australia

“Trading US Options as an Australian Resident.” - Saxo Markets Australia

“Access Global Stocks and Options.” - CMC Markets

“What are CFDs and how do they work?” - U.S. Securities and Exchange Commission (SEC)

“Investor Bulletin: An Introduction to Options.”

Our #1 Rated Bitcoin Trading Platform

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.