How to Short Tesla Canada? | 2025

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

General Disclaimer

Cryptocurrency trading involves significant risks, including the potential loss of your entire investment. Prices can be highly volatile, and past performance is not indicative of future results. Please consider your financial situation, risk tolerance, and seek independent financial advice before engaging in cryptocurrency trading.

Affiliate Disclosure

This page contains affiliate links, meaning we may earn a commission if you click through and sign up with one of our partners. This does not influence our reviews or rankings, which are based on our honest opinions and thorough research.

Updated 25/03/2025

Quick Answer:

To short Tesla in Canada, use inverse ETFs, put options, CFDs, or traditional short selling. Each method has risks, with ETFs being the easiest and short-selling the riskiest. Manage risk with stop-loss orders and hedging. Learn more about strategies and pitfalls here!

Featured Platform - eToro

- Advanced Security

- AUD Support

- Regulated & Transparent

- Low Fees

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

If there’s one stock that has stirred more debates than any other, it’s Tesla. On one side, you have got investors who think Tesla is changing the world. On the other, traders who see it as a massively overvalued tech bubble waiting to burst. I’ve followed Tesla’s rollercoaster for a few years now —and I’ve shorted it myself more than once.

Now, let me be clear: shorting Tesla can be profitable, but it’s not for the faint of heart. It’s one of the riskiest trades you can make. I’ve made money shorting Tesla. I’ve also lost money. The key is knowing your strategy, understanding your tools, and managing your risk every step of the way.

If you’re in Canada and thinking about shorting Tesla stock, this guide is for you. I’ll break down the different ways Canadians can short Tesla—ranging from traditional short selling to options, inverse ETFs, CFDs, and leveraged ETPs. I’ll also walk you through what I’ve learned along the way, so you can avoid the rookie mistakes I’ve made.

Short Selling: How does it work? (and What I’ve Learned)

What Does It Mean to Short a Stock?

Shorting a stock means betting that it will go down in price. Instead of buying low and selling high, you’re doing the opposite.

Here’s a simple breakdown:

- You borrow shares of Tesla from your broker.

- You sell them at today’s price.

- If Tesla drops, you buy the shares back at the lower price.

- You return the shares and pocket the difference.

Why would an Investor short Tesla?

Shorting Tesla is not a one-size-fits-all strategy. Over the years, I’ve used some of the best online trading platforms in Canada , each with its own methods, and I can tell you from experience—that each approach comes with its risks and costs.

- Overvaluation: Tesla often trades at price-to-earnings ratios that make traditional investors scratch their heads.

- Rising competition: Ford, GM, and Chinese brands like BYD are catching up. The EV market is getting crowded.

- Macroeconomic factors: Inflation, interest rate hikes, and economic downturns can hit growth stocks like Tesla hard.

Timing matters. You can be right about Tesla being overvalued, but if the market doesn’t agree right now, your short can blow up in your face.

What Are the Risks of Shorting Tesla Stock?

Shorting Tesla is dangerous. It’s one of the most volatile large-cap stocks in the world. When the stock turns against you, it does so quickly and violently.

Some key risks:

- Unlimited losses: When you short a stock, there’s no ceiling on how high it can go. Tesla could double, triple, or quadruple—especially during a short squeeze.

- Margin calls: If the price rises, your broker may demand more capital to maintain your position. If you can’t provide it, they’ll close your trade—usually at a loss.

- Borrowing costs: Brokers charge fees to borrow shares. With Tesla being a hotly shorted stock, those fees can be sky-high.

- Emotional pressure: Watching Tesla spike against your short can be mentally exhausting. I’ve had sleepless nights during earnings season.

When I began exploring exchanges, eToro’s CopyTrading caught my attention—it felt reassuring to learn from experienced traders. For serious trades, Kraken stands out for its low fees, but Coinbase remains my go-to for quick and easy transactions.

Most Popular Ways to Short Tesla in Canada

1. Traditional Short Selling (High Risk, High Reward)

This is the most direct method—and also the riskiest. I remember the first time I shorted Tesla this way. I felt like a trading genius… until Elon tweeted something wild and the stock spiked 20% overnight.

How It Works:

- Open a margin account with a Canadian brokerage.

- Borrow Tesla shares from your broker.

- Sell the shares.

- If the stock drops, buy them back at the lower price and return them.

Requirements & Costs of Traditional Short Selling Tesla

| Factor | What to Know |

|---|---|

| Margin account | Required. Must meet initial and maintenance margin requirements. |

| Borrowing fees | Vary based on supply and demand. Tesla borrowing can be expensive. |

| Unlimited losses | Yes. If Tesla rallies, losses can exceed your initial investment. |

| Dividends | You must pay dividends if Tesla declares them while you’re short. |

| Broker restrictions | Not all brokers always have Tesla shares available to short. |

Best for: Experienced traders only. If you’re just getting started, skip traditional shorting.

2. Shorting Tesla with Options

After using a number of trading platforms in Canada and learning the hard way with traditional short selling, I started using put options instead. Options let you bet against Tesla while capping your potential losses—a game-changer for risk management.

How Put Options Work:

A put option gives you the right (not obligation) to sell Tesla stock at a certain price before expiration. It’s like buying insurance.

- If Tesla drops, your put increases in value.

- If Tesla rises or stays flat, your loss is limited to the premium you paid.

Pros and Cons of This Method:

| Pros | Cons |

|---|---|

| Limited risk | Options can expire worthless |

| No margin account needed | Learning curve for options pricing |

| Hedging flexibility | Time decay erodes value |

| Smaller capital requirements | Volatility makes options more expensive |

I’ve used options to hedge Tesla exposure and also to make directional bets. If you time it well, they offer solid returns with far less risk than traditional shorting.

3. Inverse ETFs: Easiest Way to Bet Against Tesla

Want a simple way to short Tesla without opening a margin account or understanding options? Inverse ETFs are your friend.

These funds are designed to move in the opposite direction of Tesla or indexes that include Tesla.

Popular ETFs in Canada:

| ETF Name | Ticker | Exposure | Notes |

|---|---|---|---|

| BetaPro Inverse TSLA | TSLI | -1x Tesla | Direct Tesla inverse. Best for daily trading, not long-term. |

| Direxion Daily TSLA Bear | TSLS | -1x Tesla | Similar to TSLI. Another inverse daily play. |

| ProShares UltraShort QQQ | SQQQ | -2x Nasdaq-100 | Not Tesla-specific but works as a macro Tesla short. |

Inverse ETFs are great for short-term moves. I’ve used TSLI for intraday trades when I expected Tesla to pull back after earnings or major news.

⚠️ Important: These are for short-term use. Daily compounding causes performance decay over time.

4. Shorting Tesla with CFDs (Not for Beginners)

Contracts for Difference (CFDs) allow you to speculate on Tesla’s price movement without owning the stock. They’re leveraged instruments and highly risky.

Pros:

- Trade with leverage.

- Go long or short easily.

- Fast execution and flexible sizing.

Cons:

- High risk of losses due to leverage.

- Not available at all brokers in Canada.

- Overnight fees and spreads can eat profits.

I’ve used CFDs a few times when I wanted to quickly react to Tesla earnings or analyst downgrades. But I only recommend them for traders with experience and tight risk controls.

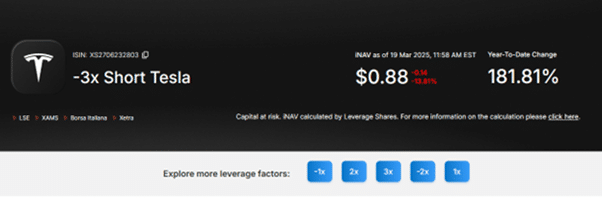

5. Leveraged ETPs: Ultra-Bearish Tesla Trades

Leveraged Exchange-Traded Products (ETPs) provide 2x or 3x inverse exposure to Tesla’s daily movements. These are extremely volatile and best reserved for very short-term trades.

Notable Products:

| ETP Name | Leverage | Canadian Access | Risk Level |

|---|---|---|---|

| Leverage Shares -2x Tesla | -2x | Yes | High (short-term) |

| GraniteShares 3x Short TSLA | -3x | No | Extreme (EU only) |

| 21Shares Short TSLA | -1x | No | Moderate (Swiss) |

These ETPs can double or triple your profits on Tesla downturns—but also magnify losses. If Tesla spikes, you could lose 20–30% in a day. Not for the faint of heart.

Should You Short Tesla?

Here’s the big question: Should you short Tesla at all?

That depends on:

- Your trading experience

- Your risk tolerance

- Your market outlook

Even if your analysis is solid, shorting requires timing and discipline. Tesla is a sentiment-driven stock, often reacting wildly to earnings, tweets, and macro trends.

Do you recommend any Key Risk Management Strategies?

- Use Stop-Loss Orders: Always have an exit plan. I never short without a stop-loss in place.

- Hedge with Options: I often buy put options alongside a short position to limit risk.

- Diversify: Don’t go all-in on Tesla short. Spread your bets and protect your portfolio.

- Stay Informed: Watch earnings, delivery numbers, and macroeconomic trends. Tesla reacts fast to news.

Final Thoughts: Is Shorting Tesla Right for You?

So, should you short Tesla? It depends on your experience level, risk tolerance, and market outlook.

✅ If you’re an experienced trader, comfortable with volatility, and know how to manage risk, shorting Tesla can be a profitable strategy.

❌ If you’re new to short selling, don’t have a risk management plan, or can’t handle high volatility, shorting Tesla is probably not for you.

Safer Alternatives to Shorting Tesla:

- Invest in Tesla competitors (e.g., BYD, Rivian, or traditional automakers like Ford) instead of outright shorting Tesla.

- Hedge Tesla exposure with put options rather than taking on unlimited short risk.

- Use inverse ETFs to bet against Tesla in a more controlled way.

If you are new to shorting, start with ETFs or put options before using high-risk strategies like margin shorting or CFDs. Tesla’s stock can be unpredictable—make sure you’re prepared before placing your bet.

FAQs

Yes! Instead of traditional short selling, you can use inverse ETFs (like BetaPro Inverse TSLA) or put options, both of which don’t require a margin account.

The safest way is through inverse ETFs, as they don’t require borrowing shares or using leverage. However, put options also limit your risk compared to direct short selling.

Tesla’s stock is volatile, meaning short squeezes, margin calls, and borrowing costs can lead to large losses. Using stop-loss orders and hedging with options can help manage risk.

Yes! The Leverage Shares -2x Tesla ETP is available in Canada, offering double inverse exposure. However, leveraged ETPs are designed for short-term trading due to daily rebalancing effects.

It depends on market conditions. If Tesla faces earnings misses, rising competition, or economic downturns, shorting could be profitable. However, high volatility and unpredictable rallies make risk management essential.

Buy Bitcoin Today!

- Advanced Security

- AUD Support

- Regulated & Transparent

- Low Fees

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References:

- Investment Industry Regulatory Organization of Canada (IIROC)

- Ontario Securities Commission (OSC)

- Nasdaq & TSX Market Data

- Interactive Brokers Canada – Short Selling Guide

- CNBC – Tesla Stock News & Investor Sentiment

- Horizons ETFs Canada – BetaPro Inverse TSLA (TSLI)

- Direxion – TSLS Tesla Short ETF

- Leverage Shares -2x Tesla ETP

Our #1 Rated Bitcoin Trading Platform

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.