How to Buy Cryptocurrency in Ireland 2025

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Updated 09/12/2024

Explore our curated list of trustworthy exchanges for purchasing cryptocurrency, each rigorously tested with real funds. All brokers are accessible to traders in Ireland.

To Buy Cryptocurrency in Ireland, Here’s What You Need to Do:

The simplest way to invest in cryptocurrency in Ireland is through a reputable crypto exchange like eToro, Coinbase, or Kraken. These platforms make it easy to buy and sell cryptocurrencies directly from your smartphone, tablet, or computer, offering secure and user-friendly experiences for Irish traders.

Featured Exchange - eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is becoming a hot topic across Ireland, especially with growing global interest following the bullish trends of 2024.

Buying cryptocurrency is now easier than ever, but it’s important to approach it with the right knowledge. In this guide, I’ll outline the key steps and best practices for Irish investors to ensure you make informed and confident decisions.

This guide is designed to provide a clear, practical, and Ireland-focused approach to purchasing cryptocurrency. Whether you’re a complete beginner or someone looking to sharpen your crypto investment skills, this resource will help you navigate the process effortlessly.

A Step-by-Step Guide on Investing in Crypto in Ireland

Step 1: Choose a Cryptocurrency Exchange

The first step to investing in cryptocurrency in Ireland is selecting a reliable cryptocurrency exchange. An exchange acts as a platform where you can buy, sell, and trade digital currencies. Here’s what to consider when choosing an exchange:

- Security: Look for platforms with robust security measures like two-factor authentication (2FA), encryption, and cold storage for funds to safeguard your investments.

- Fees: Exchanges charge varying fees for transactions and withdrawals. Compare fee structures to find a platform that aligns with your trading habits.

- User Experience: A user-friendly interface makes it easier to navigate and manage your transactions. Opt for exchanges that offer responsive customer support and helpful tools for beginners.

Top Ireland-Friendly Exchanges

Here’s a comparison of popular cryptocurrency exchanges for Irish traders:

| Feature | eToro | Coinbase | Coinbase Advanced Trade | Uphold |

|---|---|---|---|---|

| Ease of Use | Beginner-friendly, social trading | Simple interface for beginners | Advanced tools for experienced traders | Straightforward, intuitive app |

| Fees | 1% trading fee | 1.49% transaction fee | Lower fees (0.4% maker, 0.6% taker) | 0% trading fee, but higher spreads |

| Funding Options | Bank transfer, debit/credit card | Bank transfer, debit/credit card, PayPal | Bank transfer, debit/credit card | Bank transfer, debit/credit card, Apple/Google Pay |

| Crypto Selection | 75+ cryptocurrencies | 240+ cryptocurrencies | 240+ cryptocurrencies | 200+ cryptocurrencies |

| Security | FCA-regulated, 2FA, cold storage | Insured funds, 2FA, cold storage | Insured funds, 2FA, cold storage | Strong security, but not FCA-regulated |

| Extras | CopyTrading, multi-asset platform | Educational tools, staking | Advanced charting, order types | Multi-asset platform, cross-asset trades |

Best Ireland-Friendly Exchanges at a Glance:

- eToro: Best for beginners and those interested in social trading.

- Coinbase: Ideal for users seeking simplicity with strong security.

- Coinbase Advanced Trade: Tailored for experienced traders who need lower fees and advanced trading tools.

- Uphold: Excellent for zero trading fees (with higher spreads) and cross-asset trading.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

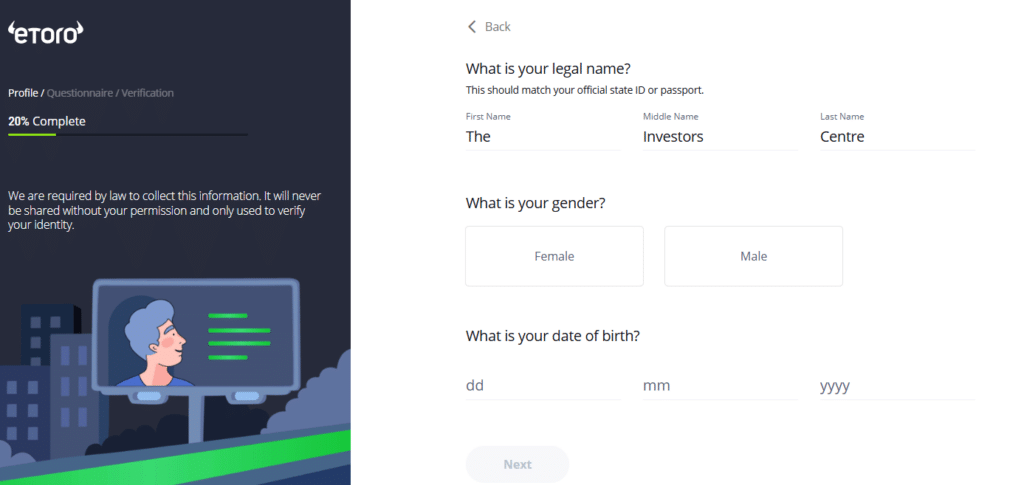

Step 2: Register and Verify Your Identity

After choosing a crypto exchange, the next step is to create an account. This process involves providing personal information and verifying your identity, commonly referred to as KYC (Know Your Customer).

Why KYC is Important:

- Security: KYC helps protect the platform from fraud and ensures that only legitimate users can access the exchange.

- Compliance: Crypto exchanges operating in Ireland and the EU must comply with anti-money laundering (AML) regulations to prevent illegal activities like money laundering or fraud.

How to Complete Registration and Verification:

- Sign Up: Visit the exchange’s website or app and click on the ‘Sign Up’ button.

- Provide Information: Enter your name, email address, and create a secure password.

- Verify Identity: Upload a government-issued ID (e.g., passport or driver’s license) and possibly take a selfie for verification.

- Set Up Security: Enable two-factor authentication (2FA) to add an extra layer of protection to your account.

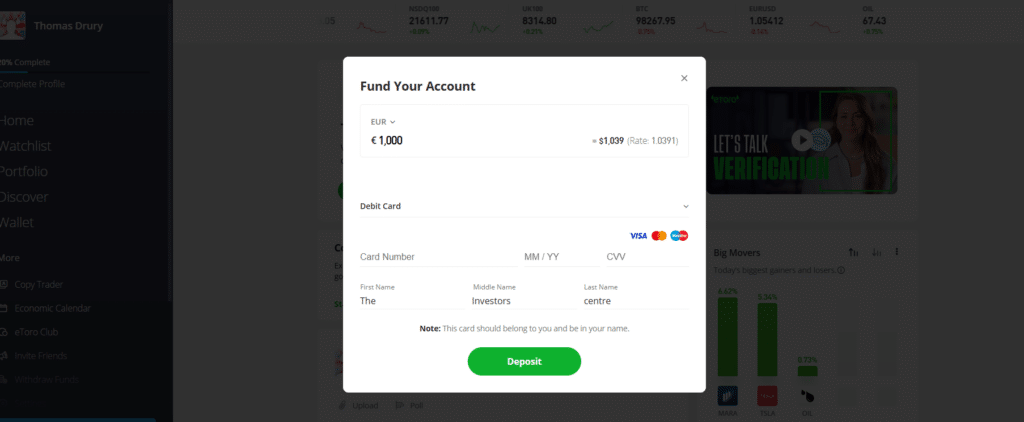

Step 3: Deposit Funds into Your Account

After verifying your account, the next step is to deposit funds so you can start buying cryptocurrency.

How to Deposit EUR:

- Bank Transfer: Link your Irish bank account to the exchange and transfer EUR. This method is usually the most cost-effective but may take 1-3 business days to process.

- Credit/Debit Card: Many exchanges accept cards for instant purchases of cryptocurrency. While convenient, this method typically incurs higher fees.

Potential Fees and Processing Times:

- Bank Transfers: Lower fees but slower processing times (1-3 business days).

- Credit/Debit Cards: Faster processing but higher fees (typically 2-4% of the transaction).

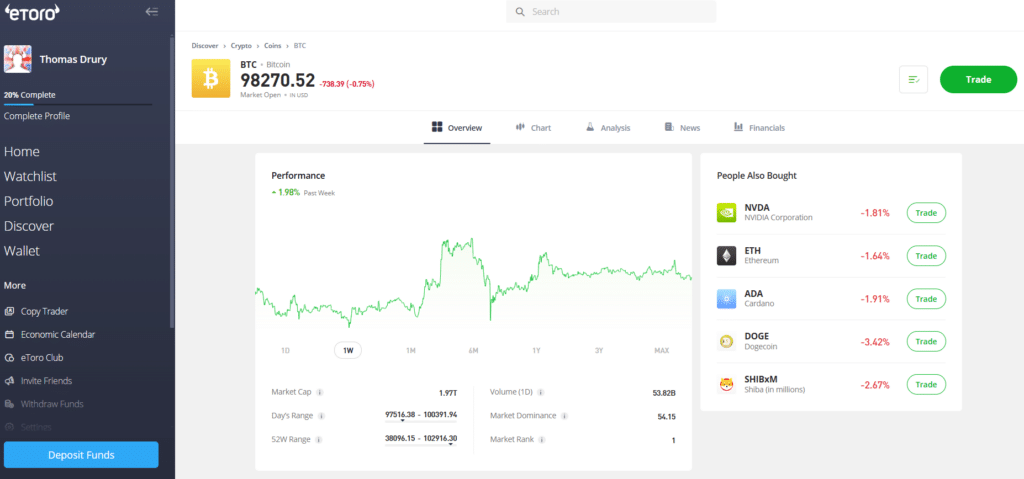

Step 4: Placing Your First Order

Once your account is funded, you’re ready to place your first order to buy cryptocurrency.

How to Place a Buy Order:

- Choose a Cryptocurrency: Select the cryptocurrency you want to purchase (e.g., Bitcoin, Ethereum).

- Enter Amount: Decide how much you want to invest in EUR or the amount of cryptocurrency you want to buy.

- Select Order Type: Choose between a market order or a limit order.

- Confirm Purchase: Review all transaction details and confirm your purchase.

Market vs. Limit Orders:

- Market Order: Executes immediately at the current market price. It’s quick and easy, perfect for beginners.

- Limit Order: Allows you to set a specific price at which you want to buy. Your order will only execute if the market reaches your set price, providing more control over your investment.

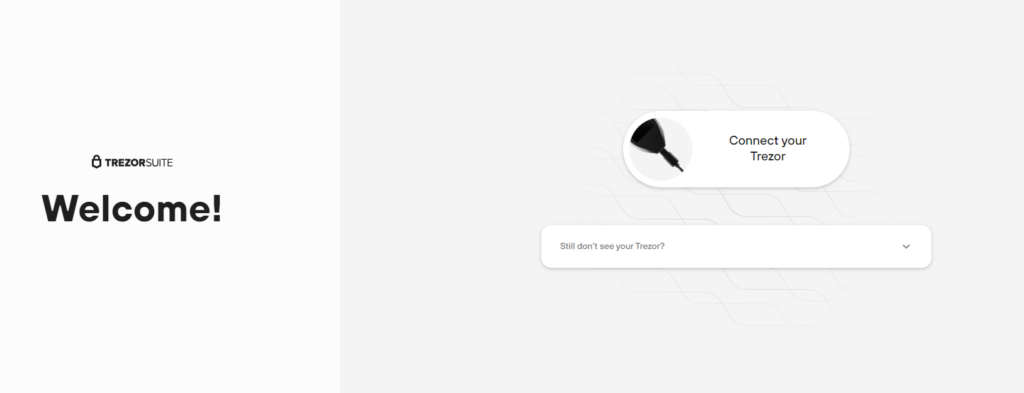

Step 5: Securing Your Investment in a Crypto Wallet

After buying cryptocurrency, securing your investment is crucial. This is where a crypto wallet becomes essential.

What is a Crypto Wallet?

A crypto wallet is a tool that stores your private keys—essentially passwords that allow you to access, send, and receive your cryptocurrencies. Keeping your private keys secure ensures you maintain control over your digital assets.

For more information on the best crypto wallets, click here.

Types of Wallets:

- Hot Wallets (Online): Connected to the internet, such as exchange wallets or mobile apps. These are convenient for quick access but are more vulnerable to hacking attempts.

- Cold Wallets (Offline): Hardware wallets or paper wallets that remain disconnected from the internet. These provide higher security but are less convenient for frequent trading.

Should You Keep Your Crypto on an Exchange or in a Wallet?

When it comes to storing cryptocurrency, you have two main options:

Keeping Crypto on an Exchange:

- Pros: Convenient for frequent trading and easy access.

- Cons: More vulnerable to hacks since exchanges are common targets.

- Security Tip: If you keep your crypto on an exchange, enable all available security measures like two-factor authentication (2FA).

Transferring to a Private Wallet:

- Pros: Greater control and enhanced security, especially with a hardware wallet.

- Cons: Less convenient as you must manage your private keys and recovery phrases.

- Security Tip: Always back up your wallet’s recovery phrase and store it in a secure location.

| Storage Option | Pros | Cons | Security Level |

|---|---|---|---|

| Exchange | Easy access, convenient trading | Higher risk of hacks | Moderate (with 2FA) |

| Private Wallet | Greater control, enhanced security | Less convenient for frequent trades | High (especially with cold storage) |

How to Choose Which Crypto to Buy

Choosing the right cryptocurrency to invest in requires careful research and a clear strategy. Here are the key factors to consider:

- Understand the Use Case: Determine the purpose of the cryptocurrency, such as payment systems (Bitcoin), smart contracts (Ethereum), or privacy-focused transactions (Monero).

- Market Position: Review its market capitalization, trading volume, and ranking on platforms like CoinGecko or CoinMarketCap.

- Community and Development: A strong developer presence and an active community often indicate the project’s long-term potential.

- Roadmap and Goals: Assess the project’s roadmap to ensure its vision aligns with emerging market trends.

- Diversify: Spread your investments across multiple cryptocurrencies to minimize risk.

What Are the Most Popular Cryptocurrencies?

With thousands of cryptocurrencies available, these are some of the most widely adopted and trusted by investors:

- Bitcoin (BTC): The first and most recognized cryptocurrency, often referred to as digital gold.

- Ethereum (ETH): Known for powering smart contracts and decentralized finance (DeFi) applications, with robust developer support.

- Tether (USDT): A stablecoin pegged to the US Dollar, frequently used for trading and hedging against volatility.

- Binance Coin (BNB): Used for transactions on the Binance Smart Chain and within the Binance ecosystem.

- Cardano (ADA): Aims to improve scalability and sustainability for blockchain projects.

What is Cryptocurrency?

Cryptocurrency is a form of digital or virtual currency secured by cryptography. Unlike traditional currencies, cryptocurrencies operate on decentralized networks using blockchain technology, which removes the need for central authority control.

Key Features of Cryptocurrency:

- Decentralization: No single entity governs the network, making it independent of centralized control.

- Peer-to-Peer Transactions: Allows direct transfers between parties without intermediaries like banks.

- Types of Cryptocurrencies: Includes payment tokens (Bitcoin), utility tokens (Ethereum), and stablecoins (Tether).

Cryptocurrencies are transforming the financial landscape, enabling a new way to store, transfer, and generate value across the globe.

What to Consider Before Investing in Crypto

Investing in cryptocurrency can be highly rewarding but comes with risks. Before you begin, consider these key points:

- Research Thoroughly: Learn about the technology, use case, and team behind the cryptocurrency.

- Volatility: Be prepared for significant price swings, as the market can be highly unpredictable.

- Regulation: Ensure compliance with Irish and EU regulations. Look for exchanges that adhere to anti-money laundering (AML) laws.

- Long-Term Potential: Evaluate the coin’s roadmap, utility, and adoption prospects to gauge its future growth potential.

- Risk Tolerance: Only invest what you can afford to lose. Cryptocurrency is a high-risk asset class.

FAQs

Yes, cryptocurrency is legal in Ireland. While it is not considered legal tender, cryptocurrencies are classified as digital assets. Irish residents can buy, sell, and trade cryptocurrencies on platforms that comply with EU and Irish regulations. However, profits from cryptocurrency investments may be subject to Capital Gains Tax (CGT), so it’s essential to maintain accurate transaction records.

Some of the safest cryptocurrency exchanges for Irish users include eToro, Coinbase, and Kraken. These platforms offer strong security features such as two-factor authentication (2FA), cold storage, and compliance with EU anti-money laundering (AML) regulations. Always choose a reputable exchange with transparent fees and a proven track record.

To store cryptocurrency safely, consider using a crypto wallet:

- Hot Wallets (Online): Ideal for frequent trading but more vulnerable to hacks.

- Cold Wallets (Offline): Hardware wallets like Ledger or Trezor offer enhanced security by keeping your assets offline.

For long-term investments, cold wallets are recommended. Always back up your recovery phrase and store it securely.

Buy Bitcoin Today!

- Copy Trading

- User Friendly Platform

- Trusted Brand

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

TIC's Best Place to Buy Crypto in Ireland

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.