Top 7 Best Brokers in Ireland for 2025 Ranked

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Updated 14/12/2024

Explore our carefully curated list of reputable Brokers, each rigorously tested with real funds. All brokers are accessible to traders in Ireland.

Quick Answer: The Best Broker for Beginners in Ireland is:

eToro is the standout choice for beginners in Ireland. Its social trading feature allows you to follow and copy the strategies of experienced investors, while its zero commission on stocks makes it affordable. The platform’s design is intuitive and easy to navigate, making it perfect for those just starting their investment journey.

Featured Exchange - eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

The Top 7 Investment Brokers Ranked:

- eToro – Zero fees, social trading, easy for beginners.

- IG – Vast markets, advanced tools, trusted name.

- XTB – Low costs, strong tools, reliable support.

- Interactive Brokers – Global access, low fees, pro-focused.

- Saxo – Advanced tools, suited for experts.

- Trading 212 – Free trading, fractional shares, beginner-friendly.

- Admiral Markets – Forex and CFDs, competitive fees.

How Do Investment Brokers Compare?

I’ve created a detailed Investment Brokers Comparison Table summarizing the platforms, their regulators, beginner scores, tradable assets, minimum deposits, Trustpilot scores, fee scores, and overall review scores.

| Platform Name | Regulator | Beginner Score (out of 5) | Tradable Assets | Minimum Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|---|---|---|

| eToro | CySEC, FCA | 5 | Stocks, ETFs, Crypto | $50 | 4.3 | 5 | 4.8 |

| IG | FCA, ASIC | 4 | Stocks, Forex, ETFs | £250 | 4.1 | 4 | 4.4 |

| XTB | FCA, KNF | 4 | Stocks, Forex, CFDs | £0 | 4.5 | 4 | 4.6 |

| Interactive Brokers | FCA, SEC | 3 | Stocks, Options, Forex | $0 | 4 | 3 | 4.2 |

| Saxo | FCA, FINMA | 3 | Stocks, Forex, Bonds | $2,000 | 3.8 | 3 | 4 |

| Trading 212 | FCA | 5 | Stocks, ETFs, Crypto | £0 | 4.4 | 5 | 4.7 |

| Admiral Markets | FCA, CySEC | 4 | Forex, CFDs, Crypto | $100 | 4.2 | 4 | 4.3 |

The 7 Best Broker Platforms:

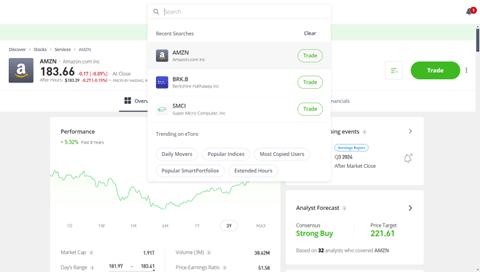

#1 eToro – Zero fees, social trading, easy for beginners.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

| Platform Name | Regulator | Beginner Score (out of 5) | Tradable Assets | Minimum Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|---|---|---|

| eToro | CySEC, FCA | 5 | Stocks, ETFs, Crypto | $50 | 4.3 | 5 | 4.8 |

Why we like it?

eToro stands out for its social trading feature, which allows beginners to copy experienced investors’ strategies. Combined with zero commission on stock trading and a simple, intuitive interface, it’s the perfect choice for anyone new to investing.

Fees and charges

eToro offers zero commission on stock trading, which is a huge advantage. However, there’s a $5 withdrawal fee, and the spreads on some assets (like crypto) can be higher compared to other brokers. Be aware of the 1% crypto conversion fee.

Tradable assets

Trade stocks, ETFs, cryptocurrencies, commodities, and forex on eToro, with thousands of assets to choose from.

Platform ease of use

eToro’s drag-and-drop interface is highly user-friendly, even for beginners with no prior trading experience.

Pros and Cons

- Pros: Easy to use, social trading, zero stock commissions, great mobile app.

- Cons: $5 withdrawal fee, high spreads on some assets, limited advanced tools.

#2 IG – Vast markets, advanced tools, trusted name.

Your capital is at risk.

| Platform Name | Regulator | Beginner Score (out of 5) | Tradable Assets | Minimum Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|---|---|---|

| IG | FCA, ASIC | 4 | Stocks, Forex, ETFs | £250 | 4.1 | 4 | 4.4 |

Pros and Cons

- Pros: Trusted reputation, low fees on stock trades, extensive asset range, strong regulation.

- Cons: Inactivity fees, complex for beginners, higher fees for some instruments.

Why we like it?

IG is trusted by Irish investors due to its strong regulatory oversight and comprehensive range of markets. It’s ideal for intermediate and advanced traders looking for professional-grade tools and competitive fees.

Fees and charges

IG charges no commissions on stocks from Irish markets. However, there’s a fee of 0.5% for currency conversion, and overnight holding costs can add up for leveraged trades. Inactivity fees (€10/month) apply after 2 years.

Tradable assets

Offers over 17,000 assets, including stocks, forex, ETFs, indices, commodities, and cryptocurrencies.

Platform ease of use

IG’s platform is customisable, with advanced tools for charting and analysis, but it may feel overwhelming for beginners.

#3 XTB – Low costs, strong tools, reliable support

Your capital is at risk.

| Platform | Regulator | Beginner Score | Tradable Assets | Min Deposit | Trustpilot Score | Fee Score | Overall Score |

|---|---|---|---|---|---|---|---|

| XTB | CySEC, FCA | 04-May | CFDs, Forex | € 0 | 4.5/5 | 4.3/5 | 4.4/5 |

Why we like it?

XTB combines low trading costs with a reliable platform, offering excellent customer service. Their educational resources make it a solid choice for beginners and intermediate traders alike.

Fees and charges

XTB has no commissions on stock CFDs, but spreads vary depending on the asset. There’s no deposit or withdrawal fee, and their fees for forex trading are among the lowest. Be cautious of overnight fees on leveraged trades.

Tradable assets

Trade forex, stocks, ETFs, and commodities through XTB, with a focus on CFDs.

Platform ease of use

The xStation 5 platform is simple to navigate yet packed with features for technical analysis.

Pros and Cons

- Pros: No deposit/withdrawal fees, strong trading tools, excellent customer service.

- Cons: Limited product range (mainly CFDs), overnight fees on leveraged positions.

#4 Interactive Brokers – Global access, low fees, pro-focused.

The inclusion of Interactive Brokers’ (IBKR) name, logo or weblinks is present pursuant to an advertising

arrangement only. IBKR is not a contributor, reviewer, provider or sponsor of content published on this site, and is not responsible for the accuracy of any products or services discussed.

| Platform | Regulator | Beginner Score | Tradable Assets | Min Deposit | Trustpilot Score | Fee Score | Overall Score |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | SEC, FCA | 3.5/5 | Global Stocks, ETFs | € 0 | 4.0/5 | 4.6/5 | 4.3/5 |

Why we like it?

Interactive Brokers (IBKR) is perfect for experienced investors who want global access to a wide range of markets. It offers ultra-low fees and advanced tools for professional traders.

Fees and charges

IBKR charges commission-free stock trades in the EU, but inactivity fees may apply for smaller accounts. Currency conversion costs and data subscriptions are additional considerations for advanced users.

Tradable assets

Access stocks, ETFs, options, futures, forex, and more across 150+ global markets.

Platform ease of use

The Trader Workstation platform is highly customisable but may feel overwhelming for less experienced traders.

Pros and Cons

- Pros: Low fees, global market access, advanced trading tools.

- Cons: Complex for beginners, inactivity fees, additional subscription costs.

#5 Saxo – Advanced tools, suited for experts.

Your capital is at risk.

| Platform | Regulator | Beginner Score | Tradable Assets | Min Deposit | Trustpilot Score | Fee Score | Overall Score |

|---|---|---|---|---|---|---|---|

| Saxo | FCA, FSA | 3.5/5 | Forex, Futures | € 500 | 3.9/5 | 4.1/5 | 4.0/5 |

Why we like it?

Saxo stands out for its cutting-edge analysis tools and professional-grade platforms. It’s ideal for experienced traders and high-net-worth individuals in Ireland.

Fees and charges

Saxo offers competitive fees for Irish investors, with U.S. stock commissions starting at 0.08% of trade value (minimum $1) and as low as 0.03% for VIP clients.

U.K. stock fees also begin at 0.08% with a £3 minimum. There are no inactivity fees, and Classic accounts have no minimum deposit, though Platinum accounts require $200,000, and VIP accounts $1,000,000. A 0.4% custody fee p.a. applies to funds, subject to 25% Danish VAT. Saxo is ideal for high-volume, experienced traders seeking advanced tools and broad market access.

Tradable assets

Trade stocks, ETFs, bonds, forex, commodities, and futures with Saxo.

Platform ease of use

The SaxoTraderGO platform is designed for advanced traders, with customisable dashboards and in-depth analysis tools.

Pros and Cons

- Pros: Excellent analysis tools, wide range of markets, strong reputation.

- Cons: High fees, high minimum deposit, less suitable for beginners.

#6 Trading 212 – Free trading, fractional shares, beginner-friendly.

Your capital is at risk.

| Platform | Regulator | Beginner Score | Tradable Assets | Min Deposit | Trustpilot Score | Fee Score | Overall Score |

|---|---|---|---|---|---|---|---|

| Trading 212 | FCA, FSC | 4.5/5 | Stocks, ETFs | € 1 | 4.6/5 | 4.7/5 | 4.5/5 |

Why we like it?

Trading 212 offers commission-free trading for stocks and ETFs, making it a budget-friendly option for Irish investors. Its clean, simple interface is ideal for beginners.

Fees and charges

Trading 212 offers zero commission on stock and ETF trades, with no hidden fees. However, there’s a 0.15% currency conversion fee on non-USD transactions. No deposit fees apply.

Tradable assets

Trade stocks, ETFs, forex, and crypto, with fractional shares available.

Platform ease of use

Trading 212’s mobile and desktop apps are intuitive, with a clean design tailored to beginners.

Pros and Cons

- Pros: Zero commissions, fractional shares, easy-to-use platform.

- Cons: Limited advanced tools, currency conversion fees.

#7 Admiral Markets – Forex and CFDs, competitive fees.

Your capital is at risk.

| Platform | Regulator | Beginner Score | Tradable Assets | Min Deposit | Trustpilot Score | Fee Score | Overall Score |

|---|---|---|---|---|---|---|---|

| Admiral Markets | FCA, ASIC | 3.5/5 | Forex, CFDs | € 100 | 4.2/5 | 4.2/5 | 4.1/5 |

Why we like it?

Admiral Markets specialises in forex and CFD trading, with competitive fees and a reputation for transparency. It’s a great choice for active traders.

Fees and charges

Admiral Markets has low spreads on forex and CFDs. There are no deposit fees, but overnight fees apply for leveraged positions. Stock CFD trading fees start from 0.02% per trade.

Tradable assets

Admiral Markets focuses on forex, CFDs, stocks, and commodities.

Platform ease of use

The MetaTrader 4 and 5 platforms are powerful but require a learning curve for beginners.

Pros and Cons

- Pros: Low spreads, transparency, excellent forex tools.

- Cons: Focus on CFDs (high risk), platform learning curve.

Factors to Consider When Choosing a Broker Platform

- Fees: Ensure you understand the costs involved, including trading commissions, spreads, deposit/withdrawal fees, and inactivity fees. Low fees are great, but hidden charges can quickly add up.

- Platform Usability: A user-friendly platform is crucial, especially for beginners. Look for intuitive navigation, responsive customer support, and mobile app availability.

- Tax Compliance: Irish investors need platforms that cater to local tax regulations, such as Dividend Withholding Tax (DWT) and Capital Gains Tax (CGT). Some brokers provide tools to simplify tax reporting, which can save you headaches.

- Support for Irish Investors: Consider brokers with a proven track record in Ireland. Strong customer support, local language options, and an understanding of Irish financial laws are essential.

- Regulatory Oversight: Ensure the broker is regulated by trusted bodies like the Central Bank of Ireland, FCA, or CySEC. Regulation guarantees security and transparency.

How Did The Investors Centre Rank the Top Brokers in Ireland

At The Investors Centre, we ranked brokers using the following criteria:

Fees and Costs: We prioritised brokers offering low or zero commissions, transparent pricing, and minimal hidden charges.

Tools and Features: Platforms with innovative tools (like social trading, charting, or tax-reporting features) scored higher.

User Reviews: We factored in Trustpilot ratings and real user feedback to assess reliability and satisfaction.

Regulation Compliance: Only brokers regulated by credible authorities like the FCA, CySEC, or Central Bank of Ireland were considered.

Beginner-Friendliness: Platforms offering educational resources, simple interfaces, and low minimum deposits earned extra points.

These criteria allowed us to present balanced recommendations that cater to both beginners and seasoned investors in Ireland.

Summary and Findings

Each broker caters to a specific audience, so finding the right fit depends on your investment style, goals, and experience. Below are my recommendations based on hands-on usage, pros and cons, and key features.

Best Broker Overall

eToro is my pick for the best overall broker in Ireland. It strikes the perfect balance between affordability, usability, and features for investors at all levels.

-

Why eToro Stands Out:

eToro offers zero commissions on stocks and ETFs, a simple interface, and a social trading feature that allows you to copy trades from experienced investors. -

Key Benefits:

- Zero fees for stock and ETF trading.

- Access to 300+ ETFs and a variety of global assets.

- Beginner-friendly with a clean, intuitive platform.

-

Drawbacks:

- Currency conversion fees for non-USD trades.

- Limited advanced tools for professional traders.

If you’re looking for a reliable, low-cost broker with an easy setup, eToro is an excellent choice.

Top Brokers for First-Time Investors

For beginners, simplicity, low fees, and learning opportunities are critical. Here are my top picks for new investors in Ireland:

-

eToro – The easiest platform to start with.

- Why: Zero-commission trading, simple interface, and the copy trading feature make investing straightforward for beginners.

- Best For: Learning by copying experienced investors while avoiding heavy fees.

-

Trading 212 – Great for low-cost, small investments.

- Why: Offers commission-free trading and fractional shares, so you can start with as little as €1.

- Best For: Small investors who want to dip their toes into ETF or stock investing.

-

XTB – Excellent support and educational tools.

- Why: XTB offers low spreads on trades, a clean platform, and a range of educational materials to help beginners build confidence.

- Best For: Learning and growing your investment knowledge.

For first-time investors, these platforms provide an accessible, affordable, and safe environment to start investing.

Best Brokers for Experienced Traders and Professionals

Advanced traders need powerful tools, low trading costs, and access to global markets. Here are the best brokers tailored to professionals:

-

Interactive Brokers – The ultimate choice for pros.

- Why: Offers access to over 150 global markets, advanced tools, and competitive fees for large trades.

- Best For: Traders needing advanced analytics, professional tools, and a vast ETF selection.

-

IG – Advanced tools and extensive market access.

- Why: IG provides professional-grade charting, thousands of ETFs, and low trading fees for active investors.

- Best For: Traders focused on ETFs and global diversification.

-

Saxo – Premium tools for high-value trades.

- Why: SaxoTraderGO is a top-tier platform with in-depth analysis tools, access to over 3,000 ETFs, and a premium trading experience.

- Best For: Experienced investors with larger portfolios who value detailed analytics and customisation.

These platforms deliver the precision, tools, and flexibility that professional investors demand for high-level trading.

FAQs

eToro is the best broker for beginners, thanks to its intuitive platform, social trading features, and zero commissions on stock trading.

The eToro mobile app is perfect for beginners. It’s easy to navigate, offers real-time updates, and lets you copy trades from seasoned investors.

For beginners, commission-free stock trading and ETFs are ideal. These options are simple, lower-risk, and a good starting point for building a portfolio.

eToro allows you to start trading with just $5 using fractional shares, making it an accessible option for small investments.

References:

- Statista. (2023). Digital Investment Market in Ireland. Retrieved from https://www.statista.com/statistics/1109020/global-online-trading-market-revenue/

- Central Bank of Ireland. (2023). Trust in Financial Institutions Survey. Retrieved from https://www.centralbank.ie/news/article/press-release-trust-in-financial-institutions-survey-results

Top 5 Brokers

1

eToro

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2

IG

Your capital is at risk.

3

XTB

Your capital is at risk.

4

IBKR

The inclusion of Interactive Brokers’ (IBKR) name, logo or weblinks is present pursuant to an advertising

arrangement only. IBKR is not a contributor, reviewer, provider or sponsor of content published on this site, and

is not responsible for the accuracy of any products or services discussed.

5

Saxo

Your capital is at risk.

Our #1 Rated Investment Platform

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.