Top 7 Best Investment Apps in Ireland 2025

Adam Woodhead

Co-Founder

Adam is a Co-Founder and content creator for The Investors Centre. His key areas of interest and expertise are cryptocurrency and blockchain technology.

Twitter ProfileAuthor Bio

Thomas Drury

Co-Founder

Seasoned finance professional with 10+ years' experience. Chartered status holder. Proficient in CFDs, ISAs, and crypto investing. Passionate about helping others achieve financial goals.

Twitter ProfileAuthor Bio

Fact Checked

How we test

At The Investors Centre, we pride ourselves on our rigorous fact-checking process. To delve deeper into our meticulous testing procedures and discover how we ensure accuracy and reliability, visit our dedicated page on how we test.

Risk Warning

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Updated 20/03/2025

Explore our carefully curated list of reputable Investment Apps, each rigorously tested with real funds. All brokers are accessible to traders in Ireland.

Quick Answer: The Best Investment App in Ireland is

For me, eToro stands out as the best investment app in Ireland. Its intuitive interface, focus on social trading, and diverse asset selection make it an unbeatable choice for beginners and experienced investors alike. The added bonus? Commission-free trading on many assets!

Featured Exchange - eToro

- Copy Trading

- User Friendly Platform

- Regulated & Trusted

- 30 Million+ Users

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

According to Statista “The digital investment market in Ireland is projected to grow by 2.46% annually from 2024 to 2028, reaching a market volume of approximately US$16.06 billion by 20281.”

The Top 7 Investment Apps Ranked:

- eToro – Zero commissions, social trading, beginner-friendly.

- IG – Wide market access, advanced tools, trusted reputation.

- XTB – Low fees, robust platform, great support.

- Interactive Brokers – Global markets, low costs, ideal for pros.

- Saxo – Advanced tools, best for experienced traders.

- Trading 212 – Commission-free, fractional shares, beginner-friendly.

- Admiral Markets – Focus on forex, CFDs, and low fees.

How Do Investment Apps Compare?

In 2025, there is a huge array of investment apps available to download and use, so we have found that it is more important than ever to make sure you choose a platform that works for you and your money. When comparing the top apps available in Ireland, it is essential to consider factors like fees, available assets, ease of use, and trustworthiness. At the Investors Centre, we carried out first-hand research into these different trading apps to provide a well-rounded review of their services. Below is a table containing a snapshot of key data points to help you decide:

| Platform | Regulator | Beginner Score | Tradable Assets | Min Deposit | Trustpilot Score | Fee Score | Overall Score |

|---|---|---|---|---|---|---|---|

| eToro | CySEC, FCA | 4.5/5 | Stocks, ETFs, Crypto | €50 | 4.4/5 | 4.5/5 | 4.6/5 |

| IG | FCA | 4/5 | Stocks, Forex, ETFs | €300 | 4.3/5 | 4/5 | 4.3/5 |

| XTB | CySEC, FCA | 4/5 | CFDs, Forex | €0 | 4.5/5 | 4.3/5 | 4.4/5 |

| Interactive Brokers | SEC, FCA | 3.5/5 | Global Stocks, ETFs | €0 | 4.0/5 | 4.6/5 | 4.3/5 |

| Saxo | FCA, FSA | 3.5/5 | Forex, Futures | €500 | 3.9/5 | 4.1/5 | 4.0/5 |

| Trading 212 | FCA, FSC | 4.5/5 | Stocks, ETFs | €1 | 4.6/5 | 4.7/5 | 4.5/5 |

| Admiral Markets | FCA, ASIC | 3.5/5 | Forex, CFDs | €100 | 4.2/5 | 4.2/5 | 4.1/5 |

The 7 Best Investment Apps:

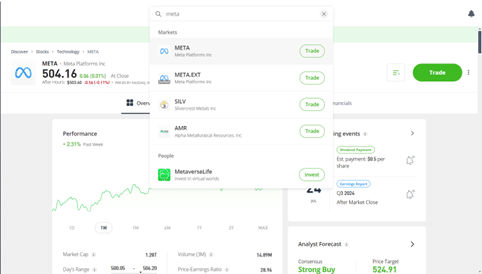

#1 eToro – Zero commissions, social trading, beginner-friendly.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

| Beginner Score | Min Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|

| 4.5/5 | €50 | 4.4/5 | 4.5/5 | 4.6/5 |

Why we like it?

I love eToro’s social trading feature, which allows users to copy the portfolios of experienced traders. For beginners, this is invaluable.

Its simplicity and zero-commission trading make it my top recommendation for new investors.

According to Statista “As of June 2023, eToro had 35 million registered users worldwide, reflecting its extensive global reach2.”

Fees and charges

eToro charges no commission for stock and ETF trades, but withdrawals incur a $5 fee, and forex spreads start from 1 pip, which is higher than IG’s. While these fees are tolerable, the inactivity fee of $10 per month kicks in after 12 months.

Tradable assets

With stocks, ETFs, cryptocurrencies, indices, and forex, eToro covers most popular asset classes. However, the lack of access to bonds may deter some conservative investors.

Platform ease of use

eToro’s interface is incredibly intuitive. The CopyTrader tool simplified my learning curve, and the mobile app makes trading on the go seamless. The platform also provides a virtual account for practice.

Pros and Cons

- Beginner-friendly interface.

- Social trading tools to learn from experts.

- Commission-free stock trading.

- No Bonds

- High forex spreads compared to IG.

#2 IG - Comprehensive market access, professional-grade tools, strong reputation

Your capital is at risk.

| Beginner Score | Min Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|

| 4/5 | €300 | 4.3/5 | 4/5 | 4.3/5 |

Pros and Cons

- Wide range of tradable assets.

- Trusted, FCA-regulated platform.

- Comprehensive educational resources.

- Inactivity fee for dormant accounts.

- Higher minimum deposit compared to competitors.

Why we like it?

IG provides unparalleled access to global markets with professional-grade tools. Its reputation for reliability makes it a go-to platform for serious investors. For me, the variety of assets was a game-changer when diversifying my portfolio.

Fees and charges

IG’s fees are transparent, but there’s a monthly £12 inactivity fee after two years of no trading. Forex spreads are competitive, starting at 0.6 pips, and their share dealing fees range from £3 to £8, depending on trading frequency. The platform also avoids hidden charges, which I appreciated.

Tradable assets

IG offers access to 17,000+ markets, including stocks, ETFs, forex, cryptocurrencies, commodities, and indices. The breadth of choice allows for extensive diversification, catering to both long-term and short-term strategies.

Platform ease of use

The desktop platform is feature-rich, but I found the mobile app more intuitive. Beginners may need time to adapt to the tools, but the customisable interface eventually becomes second nature. Educational resources are also extensive.

#3 XTB – Low fees, robust platform, great support.

Your capital is at risk.

| Beginner Score | Min Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|

| 4/5 | €0 | 4.5/5 | 4.3/5 | 4.4/5 |

Why we like it?

XTB offers a comprehensive range of financial instruments with competitive fees and a user-friendly platform. Its commitment to customer service and educational resources makes it appealing for both beginners and experienced traders.

Fees and charges

XTB provides commission-free trading on stocks and ETFs up to a monthly volume of €100,000; beyond this, a 0.2% commission applies. Forex spreads are competitive, starting from 0.8 pips. There’s an inactivity fee of €10 monthly after one year of inactivity.

Tradable assets

The platform offers over 5,700 financial instruments, including forex, CFDs, stocks, ETFs, commodities, and cryptocurrencies, allowing for extensive portfolio diversification.

Platform ease of use

XTB’s proprietary xStation 5 platform is intuitive and customizable, featuring advanced charting tools and a seamless mobile app experience, catering to traders of all levels.

Pros and Cons

- Commission-free trading on stocks and ETFs up to €100,000 monthly volume.

- Extensive range of tradable instruments.

- Robust educational resources for traders.

- Inactivity fee after one year of inactivity.

- No support for third-party platforms like MetaTrader

#4 Interactive Brokers – Global markets, low costs, ideal for pros.

The inclusion of Interactive Brokers’ (IBKR) name, logo or weblinks is present pursuant to an advertising

arrangement only. IBKR is not a contributor, reviewer, provider or sponsor of content published on this site, and is not responsible for the accuracy of any products or services discussed.

| Beginner Score | Min Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|

| 3.5/5 | €0 | 4.0/5 | 4.6/5 | 4.3/5 |

Why we like it?

Interactive Brokers offers unmatched global market access and the some of the lowest trading fees I’ve encountered. It’s perfect for investors who demand professional-level tools and flexibility.

Fees and charges

This platform boasts ultra-low fees, with no inactivity fee and some stock trading commissions as low as $0.005 per share. However, complex pricing structures might overwhelm casual users, and margin rates, though low, require careful management.

Tradable assets

Access to stocks, ETFs, options, futures, bonds, and more across global markets is unmatched. The diversity here is a key reason I recommend it to serious investors.

Platform ease of use

Interactive Brokers caters more to professionals, with a steep learning curve for its Trader Workstation software. I found the mobile app simpler, but it’s still less intuitive than eToro or Trading 212.

Pros and Cons

- Access to global markets.

- Lowest trading fees in the industry.

- Highly advanced tools.

- Steep learning curve on platfrom for beginners

- Complex fee structure.

#5 Saxo – Advanced tools, best for experienced traders.

Your capital is at risk.

| Beginner Score | Min Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|

| 3.5/5 | €500 | 3.9/5 | 4.1/5 | 4.0/5 |

Why we like it?

Saxo offers a premium experience with professional tools and detailed market insights. I appreciate its advanced research capabilities, which are invaluable for active traders.

Fees and charges

While Saxo’s fees are competitive for large accounts, smaller traders might feel burdened. Stock trading fees start at £8 per trade, and inactivity fees apply after three months.

Tradable assets

The platform offers a range of forex, CFDs, stocks, and futures, making it a strong choice for advanced investors. However, its focus leans towards active traders.

Platform ease of use

Saxo’s interface is highly customisable, but it’s not beginner-friendly. Tools like SaxoTraderGO offer excellent functionality but demand a steep learning curve.

Pros and Cons

- Access to global markets.

- Lowest trading fees in the industry.

- Highly advanced tools.

- Steep learning curve on platfrom for beginners

- Complex fee structure.

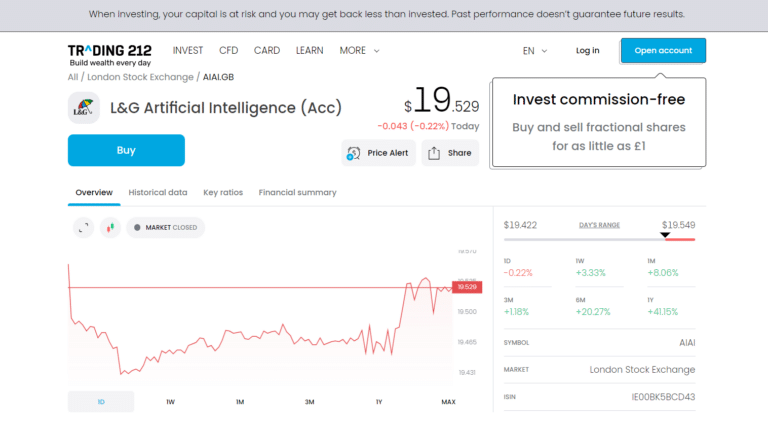

#6 Trading 212 – Commission-free, fractional shares, beginner-friendly.

Your capital is at risk.

| Beginner Score | Min Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|

| 4.5/5 | €1 | 4.6/5 | 4.7/5 | 4.5/5 |

Why we like it?

Trading 212’s zero-commission trading and low deposit requirement make it the best platform for beginners. I found the app particularly enjoyable for its simplicity and smooth performance.

Fees and charges

Trading 212 offers truly commission-free trading on stocks and ETFs, with minimal spreads on forex and CFDs. There are no withdrawal or inactivity fees, which adds to its appeal.

Tradable assets

The platform provides access to stocks, ETFs, and forex, though it lacks futures and options for advanced traders.

Platform ease of use

The app is designed with beginners in mind. Its clean interface and demo account feature made my early trading experience easy and enjoyable.

Pros and Cons

- Zero-commission trading.

- User-friendly interface.

- Low entry barrier.

- Limited asset variety.

- Not ideal for professionals.

#7 Admiral Markets – Focus on forex, CFDs, and low fees.

Your capital is at risk.

| Beginner Score | Min Deposit | Trustpilot Score | Fee Score | Overall Review Score |

|---|---|---|---|---|

| 3.5/5 | €100 | 4.2/5 | 4.2/5 | 4.1/5 |

Why we like it?

Admiral Markets excels in forex and CFD trading, with competitive fees and access to the MetaTrader platform. For those focused on forex, it’s an excellent choice.

Fees and charges

Forex spreads start from 0.5 pips, and there’s no inactivity fee. However, stock CFDs incur higher charges compared to IG or eToro.

Tradable assets

Admiral Markets focuses on forex, CFDs, and indices, with fewer options for traditional stocks or ETFs.

Platform ease of use

MetaTrader 4 is robust but less intuitive for beginners. However, I enjoyed the flexibility of its advanced charting tools and expert advisors.

Pros and Cons

- Competitive forex fees.

- Access to MetaTrader platform.

- Strong educational content.

- Limited stock options.

- MetaTrader can be overwhelming for beginners.

What Factors to Consider When Choosing an Investment App?

Choosing the right investment platform in 2025 depends on fees, usability, asset availability, and trustworthiness.

We have found that High fees can erode profits, so it is essential to compare pricing structures. Usability matters too, as many traders can tell you; an intuitive interface saves time and avoids frustration.

Finally, keep a lookout for platforms and apps that offer a broad range of assets to match your goals. Finally, ensure a reputable authority like the FCA regulates the platform for safety and reliability.

How Did The Investors Centre Rank the Top Investment Apps in Ireland?

Our rankings are based on key metrics to balance cost, user experience, and functionality.

Fee structures were analysed to ensure affordability, while usability scores reflected platform intuitiveness for both beginners and experienced traders.

Asset variety was critical to evaluate options for diversification, and regulation ensured user funds are protected.

Finally, customer reviews and my personal experience helped identify strengths and drawbacks for each platform.

Fees and Costs: What Are You Really Paying?

Understanding the actual cost of investing is essential when choosing an investment app. While many platforms advertise commission-free trading, there are still a number of additional fees that traders need to consider since they can impact overall returns. Spreads, withdrawal fees, inactivity charges, and currency conversion fees are common expenses that investors should consider. Some platforms, like eToro and Trading 212, offer zero-commission stock trading but make money through wider spreads or foreign exchange fees when dealing with non-euro assets.

On the other hand, apps like Interactive Brokers and Saxo Bank charge tiered commissions but provide access to premium market data and advanced tools. Investors in Ireland in the market for Contract for Difference (CFD) trading should keep in mind that it will involve overnight fees, which can add up for long-term positions.

Before committing to an app, investors should take time to review fee and cost structure to ensure they’re getting the best value without unexpected costs eating into their profits.

What are Micro-Investing Apps? And should I use them?

Micro-investing apps have revolutionised investing by allowing users to invest small amounts effortlessly. These apps round up everyday purchases to the nearest euro and automatically invest the spare change, making investing accessible to beginners who may not have large capital.

Many of these platforms offer diversified portfolios, automatic rebalancing, and user-friendly interfaces that simplify the investment process. Revolut, for example, provides commission-free trading, while Moneybox integrates seamlessly with bank accounts to allocate funds into ETFs or retirement accounts.

While micro-investing is an excellent entry point, users should be aware of potential fees that may reduce overall returns.

What Markets and Exchanges can I trade on in Ireland?

Investment apps in Ireland provide access to a wide range of markets and exchanges, allowing investors to diversify their portfolios beyond domestic stocks. The best platforms offer global reach, enabling users to trade stocks, ETFs, forex, commodities, bonds, and cryptocurrencies across multiple exchanges.

Many apps provide access to major stock exchanges, including the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange (LSE), and Euronext Dublin, where investors can trade blue-chip stocks, ETFs, and index funds.

Forex traders in Ireland benefit from apps that offer currency pairs across global forex markets. At the same time, commodity investors can trade gold, coffee, gas and agricultural products (such as cotton and milk) through futures or ETFs. Traders based in Ireland who are interested in fixed-income securities can access government and corporate bonds. In contrast, investors based in Ireland who want to trade cryptocurrency can trade Bitcoin, Ethereum, and altcoins on regulated platforms.

Are my funds protected if I use Investment Apps?

Security and regulation are crucial when selecting an investment app in 2025. Reputable platforms in Ireland operate under financial regulators like the Financial Conduct Authority (FCA), and Central Bank of Ireland (CBI), ensuring compliance with strict guidelines for investor protection.

Top investment apps implement encryption, two-factor authentication (2FA), and fund segregation to safeguard user funds and data. Many also offer protection under compensation schemes like the Financial Services Compensation Scheme (FSCS) or the Investor Compensation Scheme (ICS), which provide coverage in case of broker insolvency.

Verifying a platform’s regulatory status and security measures is essential to ensure a safe and transparent investing experience.

How Did We Calculate the Rankings for the Top Investment Apps in Ireland?

Our rankings are based on key metrics to balance cost, user experience, and functionality.

Fee structures were analysed to ensure affordability, while usability scores reflected platform intuitiveness for both beginners and experienced traders.

Asset variety was critical to evaluate options for diversification, and regulation ensured user funds were protected.

Finally, customer reviews and personal experiences helped identify the strengths and drawbacks of each platform.

Which Apps Are Recommended for Each Trader?

For beginners who prefer ease of use and a simple onboarding process, eToro is the best choice. If you want a structured learning experience with low-cost trading, XTB is another excellent choice, offering extensive educational resources alongside a robust and cost-effective platform.

If you are a high-frequency trader or professional investor looking for deep market access and advanced tools, Interactive Brokers and Saxo are standout options. Interactive Brokers provides one of the most comprehensive selections of tradable assets worldwide, with industry-leading execution speeds and margin trading capabilities. Saxo, on the other hand, is tailored for high-net-worth and experienced traders who require premium research, exclusive insights, and sophisticated order execution.

For those focused on forex and CFD trading, IG and Admiral Markets provide low spreads, advanced charting tools, and access to MetaTrader 4 and 5. IG is well-established and offers an extensive range of forex pairs, while Admiral Markets caters to those who want low-cost CFD trading with strong risk management features.

If you prefer commission-free investing with fractional shares, Trading 212 is an excellent alternative. This platform is ideal for investors looking to start with small amounts while gaining exposure to a wide range of global stocks and ETFs.

Each of the brokers we have featured is regulated by reputable authorities like the FCA, CySEC, and SEC, ensuring investor protection and transparency.

Summary and Key Takeaways

Choosing the right investment app in Ireland depends on factors like fees, asset variety, security, and usability. eToro stands out as the best overall app for its social trading features and commission-free stock trading, while Interactive Brokers and Saxo Bank cater to professionals with advanced tools and global market access.

Investment apps provide opportunities to trade across major stock exchanges like the NYSE, LSE, and Euronext Dublin, along with forex, commodities, bonds, and cryptocurrencies. Micro-investing apps like Revolut and Moneybox offer an accessible entry point for beginners, while high-frequency traders may benefit from low-cost CFD platforms.

Security is a key factor, with leading platforms regulated by the FCA, CySEC, and the Central Bank of Ireland. Many also offer investor protection through schemes like FSCS or ICS. While some apps advertise commission-free trading, investors must be aware of other fees, such as spreads, withdrawal costs, and currency conversion charges.

Ultimately, selecting the best investment app depends on your experience level, investment goals, and preferred markets. By considering these factors, you can find a platform that aligns with your financial strategy and ensures a safe, cost-effective investing experience.

FAQs

Investment platforms are online services that allow users to buy, sell, and manage assets like stocks, ETFs, and forex. They provide tools for research, portfolio management, and sometimes social trading. These platforms simplify investing for individuals.

Investment platforms act as intermediaries between investors and financial markets. Users fund their accounts, select assets to trade, and execute transactions online. Platforms often provide tools for analysis, market data, and performance tracking, making investing more accessible.

For beginners, eToro is an excellent choice. Its social trading features, commission-free stock trades, and user-friendly interface make learning and investing simple. The demo account is perfect for practicing before risking real money.

High net worth individuals should consider Interactive Brokers or Saxo. Both offer access to global markets, advanced tools, and bespoke services. Their platforms cater to complex portfolios and large-scale investments with competitive fees.

While Ireland doesn’t have ISAs, PRSA pensions and investment bonds offer tax-efficient options. Gains within pensions grow tax-free, and Exit Tax (41%) applies to certain Irish-domiciled funds. Always consult a financial advisor for tailored tax advice.

Not necessarily. While platforms like eToro and Interactive Brokers have global appeal, availability, fees, and features can vary by country due to regulations. For example, ISAs on Interactive Investor are exclusive to the UK. Explore our other pages for more information: Best Investing Apps UK, Best Investing Apps Ireland.

References:

- Statista. (2023). Digital Investment Market in Ireland. Retrieved from https://www.statista.com/outlook/dmo/fintech/digital-investment/ireland

- BBC. (2023). How younger investors are reshaping digital trading. Retrieved from https://www.bbc.com/news/business-57466918

- Central Bank of Ireland (CBI). (2025).

https://www.centralbank.ie/home - Financial Conduct Authority (FCA). (2025)

https://www.fca.org.uk/ - Financial Services Compensation Scheme (FSCS). (2025)

https://www.fca.org.uk/ - “https://investingreviews.co.uk/trading/best-trading-platforms-uk/”The 6 Leading Investment Apps in Ireland [2025]: An overview of top investment apps available in Ireland. bestinireland.com

- “https://www.reddit.com/r/irishpersonalfinance/comments/1f48024/best_online_brokerage_in_ireland_for_buying_stocks/”

Top 5 Investing Apps

1

eToro

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2

IG

Your capital is at risk.

3

XTB

Your capital is at risk.

4

IBKR

The inclusion of Interactive Brokers’ (IBKR) name, logo or weblinks is present pursuant to an advertising

arrangement only. IBKR is not a contributor, reviewer, provider or sponsor of content published on this site, and

is not responsible for the accuracy of any products or services discussed.

5

Saxo

Your capital is at risk.

Our #1 Rated Investment Platform

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.