7 Best Trading Platforms in Ireland 2025

Profile

Co-Founder

Thomas brings extensive experience in financial analysis and investment research. With a strong background in both institutional and retail investment sectors, Thomas ensures all content meets the highest standards of accuracy and relevance.

Follow on Twitter"Every piece of investment advice should be grounded in solid research and practical application. My role is to ensure our content provides real value to investors at every level."

My Favourite Writes:

Profile

Co-Founder

Dom is an experienced retail investor, learning his craft in what he likes to call the "hard way". Through many of these lessons he has crafted himself a sound investment strategy that has enabled him to make investing into a business not just a hobby.

Follow on Twitter"Financial clarity and integrity are the cornerstones of everything we do. We're here to ensure that your investment journey is built on a solid financial understanding and a sound strategic foundation."

My Favourite Writes:

Profile

Co-Founder

Adam is a passionate investor who created The Investors Centre (TIC) to combine his professional skills with his love for investment.

Follow on Twitter"Investment is about more than just numbers; it's about strategy, research, and the willingness to adapt."

My Favourite Writes:

How We Test

Our Commitment to Accuracy

At The Investors Centre, we maintain the highest standards of accuracy and reliability in all our investment education content. Every article undergoes rigorous fact-checking and review processes.

Our Testing & Verification Process

- Primary Research: We gather data directly from official sources including company reports, regulatory filings, and government databases.

- Platform Testing: Our team personally tests and evaluates investment platforms, creating accounts and documenting real user experiences.

- Expert Analysis: Content is reviewed by experienced investors and financial professionals within our team.

- Data Verification: All statistics, figures, and claims are cross-referenced with multiple authoritative sources.

- Regular Updates: We review and update content quarterly to ensure information remains current and accurate.

Review Standards

- Independence: We maintain editorial independence and disclose any potential conflicts of interest.

- Transparency: Our testing methodology and evaluation criteria are clearly documented.

- Objectivity: Reviews are based on measurable criteria and standardized testing procedures.

Corrections Policy

If errors are identified, we correct them promptly and note significant updates at the bottom of articles. Readers can report inaccuracies to our editorial team at info@theinvestorscentre.co.uk

Last Review Date

This article was last fact-checked and updated on: October 23, 2025

Disclaimer

Educational Purpose Only

All content on The Investors Centre is provided for educational and informational purposes only. It should not be construed as personalised investment advice, financial advice, or a recommendation to buy, sell, or hold any investment or security.

No Financial Advice

We are not authorised by the Financial Conduct Authority (FCA) to provide investment advice. Content on this website does not constitute financial advice, and you should not rely on it as such. Always consult with a qualified financial advisor or professional before making investment decisions.

Investment Risks

Investing carries inherent risks, including the potential loss of principal. Past performance does not guarantee future results. The value of investments can go down as well as up, and you may not get back the amount originally invested.

Accuracy & Completeness

While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained on this website.

Third-Party Content & Links

This website may contain links to third-party websites and references to third-party products or services. We do not endorse, control, or assume responsibility for any third-party content, privacy policies, or practices. Users access third-party sites at their own risk.

Affiliate Disclosure

Some links on this site may be affiliate links. If you click on these links and make a purchase or sign up for a service, we may receive a commission at no additional cost to you. This does not influence our editorial content or reviews.

Personal Responsibility

Any action you take upon the information on this website is strictly at your own risk. We will not be liable for any losses or damages in connection with the use of our website or the information provided.

Regulatory Notice

Investment products and services featured on this website may not be available in all jurisdictions or to all persons. Users are responsible for complying with local laws and regulations.

Contact Information

For questions about this disclaimer or our content, please contact:

Email: info@theinvestorscentre.co.uk

Last Updated

This disclaimer was last updated on: August 2025

Explore our carefully curated list of reputable Trading Platforms, each rigorously tested with real funds. All brokers are accessible to traders in Ireland.

eToro

IE Trading Score: 4.7/5

51% of retail CFD accounts lose money.

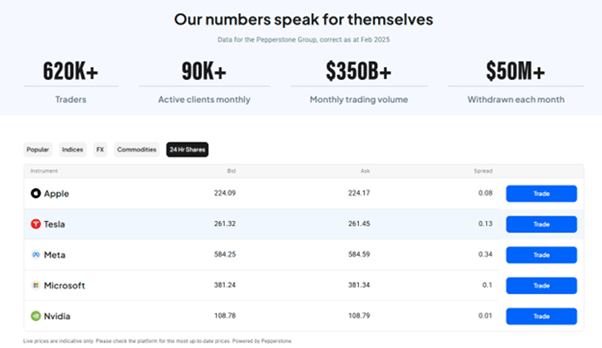

Pepperstone

IE Trading Score: 4.5/5

81.7% of retail CFD accounts lose money.

Spreadex

IE Trading Score: 4.4/5

65% of retail CFD accounts lose money.

AvaTrade

IE Trading Score: 4.4/5

76% of retail CFD accounts lose money.

IG

IE Trading Score: 4.3/5

67% of retail CFD accounts lose money.

XTB

IE Trading Score: 3.9/5

73% of retail CFD accounts lose money.

Quick Answer: What is the Best Trading Platform in Ireland?

If you’re in Ireland and searching for the best trading platform, eToro is our top pick. It’s beginner-friendly, offers commission-free stock trading, and includes unique features like social trading, which lets you copy the strategies of successful traders. It’s a great starting point!

How Do These Trading Platforms Compare?

| Platform | Regulation | Fees | Asset Availability | Platforms/Tools | Pros | Cons | Minimum Deposit |

|---|---|---|---|---|---|---|---|

| eToro | CySEC, FCA, ASIC | Commission-free stocks; $5 withdrawal | Stocks, ETFs, Crypto | Proprietary platform, mobile app | Beginner-friendly, social trading | Limited tools for pros | $10 |

| Pepperstone | FCA, ASIC, BaFin | Low spreads; no deposit fees | Forex, CFDs | MT4, MT5, cTrader | Tight spreads, fast execution | No proprietary platform | $200 |

| SpreadEX | FCA | Spread betting fees vary | Forex, Indices, Shares | Proprietary platform | Unique betting options | Limited asset range | $1 |

| AvaTrade | Central Bank of Ireland | Fixed spreads; no hidden fees | Forex, Crypto, Stocks, Options | MT4, MT5, AvaOptions | Regulated in Ireland, diverse assets | Limited customer support times | $100 |

| IG | FCA, CFTC, ASIC | Spread fees; inactivity fees | Stocks, Forex, Indices, Crypto | Proprietary platform, mobile app | Established reputation, global reach | High fees for small trades | £250 |

| XTB | FCA, CySEC, KNF | Commission-free under certain conditions | Forex, Indices, Commodities | xStation 5, mobile app | Advanced tools, no deposit fees | Limited customer support | £50 |

| Saxo | FSA, FINMA, ASIC | High fees for small accounts | Stocks, Forex, Bonds, ETFs | SaxoTraderGO, SaxoTraderPRO | Premium services, wide asset range | High minimum deposit | € 2,000 |

Overview of the Top 7 Trading Platforms

- eToro: Beginner-friendly with social trading tools.

- Pepperstone: Low spreads for forex and CFDs.

- SpreadEX: Spread betting with unique features.

- AvaTrade: Diverse assets with beginner resources.

- IG: Established platform with a global reach.

- XTB: Advanced tools for professional traders.

- Saxo: Premium platform with high-end services.

Enhanced Fee Comparison Example

| Platform | Stock Trade Fee (per $1,000) | Withdrawal Fee | Inactivity Fee |

|---|---|---|---|

| eToro | $0 | $5 | $10/month after 12 months |

| Pepperstone | $3 | Free | None |

| SpreadEX | Spread-based | Free | None |

| AvaTrade | Fixed spreads | Free | None |

| IG | $6 | Free | £12/month after 2 years |

| XTB | $0 (with conditions) | Free | None |

| Saxo | $10 | Free | None |

Pros & Cons

- Beginner-friendly

- commission-free stock trading

- Social trading tools

- Regulated by top-tier authorities

- Limited tools for advanced traders

- $5 withdrawal fee

-

What are the Fees?

-

Which Trading Assets are Available?

-

How Safe is the Broker?

- Deposit: Free

- Withdrawal: $5

- Trading: Commission-free stocks; spreads on other assets

Stocks, ETFs, Forex, Cryptocurrencies, Commodities

- Regulated by CySEC, FCA, and ASIC.

- High level of encryption and security measures.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 51% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Tight spreads

- Fast execution

- Excellent forex tools.

- No proprietary platform

- Higher minimum deposit

-

What are the Fees?

-

Which Trading Assets are Available?

-

How Safe is the Broker?

- Deposit: Free

- Withdrawal: Free

- Trading: Competitive spreads

Forex, CFDs, Commodities, Indices

- Regulated by FCA, ASIC, and BaFin.

- Trusted by traders globally with robust security features.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 81.7% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Unique spread betting options

- Low minimum deposit

- Limited asset range

-

What are the Fees?

-

Which Trading Assets are Available?

-

How Safe is the Broker?

- Deposit: Free

- Trading: Varies depending on spreads.

Forex, Indices, Shares

- Regulated by FCA.

- Focuses heavily on user security and compliance.

65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros & Cons

- Diverse asset offering

- Regulated in Ireland

- Limited customer support hours

-

What are the Fees?

-

Which Trading Assets are Available?

-

How Safe is the Broker?

- Deposit: Free

- Withdrawal: Free

- Trading: Fixed spreads

Forex, Cryptocurrencies, Stocks, Options, Commodities

- Regulated by the Central Bank of Ireland.

- Offers negative balance protection and high-level security.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 76% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Established reputation

- Global market access

- High fees for small accounts

-

What are the Fees?

-

Which Trading Assets are Available?

-

How Safe is the Broker?

- Deposit: Free

- Withdrawal: Free

- Trading: Spreads and inactivity fees apply.

Stocks, Forex, Indices, Cryptocurrencies

- Regulated by FCA, CFTC, and ASIC.

- Over 45 years in the market with advanced security protocols.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Pros & Cons

- Advanced tools

- Low fees

- Excellent for pros

- Limited customer support options

-

What are the Fees?

-

Which Trading Assets are Available?

-

How Safe is the Broker?

- Deposit: Free

- Withdrawal: Free

- Trading: Commission-free under certain conditions

Forex, Indices, Commodities, Cryptocurrencies

- Regulated by FCA, CySEC, and KNF.

- Emphasis on secure trading environments.

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros & Cons

- Premium services

- Wide asset range

- High minimum deposit

- Higher fees for small traders

-

What are the Fees?

-

Which Trading Assets are Available?

-

How Safe is the Broker?

- Deposit: Free

- Withdrawal: Free

- Trading: Higher spreads and commissions for small accounts.

Stocks, Forex, Bonds, ETFs, Commodities

- Regulated by FSA, FINMA, and ASIC.

- Known for high-end security and professional-grade services.

CFDs are complex instruments with a high risk of losing money rapidly due to leverage. 64% of retail CFD accounts lose money when trading CFD’s with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What Are Trading Platforms and How Do They Actually Work?

I remember the first time I opened an account with an online trading platform. It felt a bit overwhelming. But once I got the hang of it, I realised at their core, these online platforms can connect you to global financial markets—whether you’re trading forex, buying stocks, or dabbling in crypto.

Most platforms today are super accessible. You can log in from your laptop or phone, track market trends, and execute trades almost instantly. A good platform offers features like detailed charts to spot trading opportunities, tools to manage risk (like stop-loss orders), and a secure interface for handling your money. The beauty is, whether you’re a beginner or a pro, there is a platform out there tailored specifically to your needs.

For Irish traders, regulation is key. Make sure the platform is approved by the Central Bank of Ireland or equivalent EU authorities. And when choosing your platform, consider ease of use. I’ve tried platforms that made me feel like I needed a master’s degree just to log in. My advice would be to go for one that feels intuitive, even if you’re still learning the ropes.

What do I need to know about Investing in Stocks from Ireland?

These days, getting started with stock trading in Ireland is more accessible than ever.

First, you’ll need to open a trading account with a broker regulated by the Central Bank of Ireland.

After verifying your identity, you can fund your account using a bank transfer or card payment. From there, you can invest in individual stocks, ETFs, or even participate in initial public offerings, follow-on offerings, or private placements on global markets.

As you build your investment portfolio, it’s helpful to understand concepts like earnings multiples and the broader equity capital market. Most platforms will display real-time stock trading fees, so you know exactly what you’re paying. If you’re new, free resources like eToro Academy can help you learn the basics.

How do these platforms compare in terms of popularity?

User Ratings and Popularity Insights

- eToro: 4.7/5 – Highly popular for its beginner-friendly features and social trading.

- SpreadEX: 4.3/5 – Favored by users seeking spread betting and tax-efficient trading options.

- AvaTrade: 4.5/5 – Praised for its local support and diverse asset options.

- IG: 4.6/5 – A trusted choice among experienced traders for its global market reach.

- Pepperstone: 4.4/5 – Low spreads make it ideal for forex traders.

- XTB: 4.4/5 – Advanced tools appeal to professional traders.

- Saxo: 4.2/5 – Premium services attract high-net-worth individuals.

| Broker | Popularity Among Irish Investors | Key Features |

|---|---|---|

| eToro | Highly popular for its beginner-friendly interface and social trading features. | 0% commission on trades; access to global markets; social trading capabilities. |

| DEGIRO | Favored for its low fees and extensive market access. | Low-cost trading; access to over 50 stock markets; user-friendly platform. |

| Interactive Brokers | Preferred by experienced traders for its comprehensive tools and low FX fees. | Access to a wide range of asset classes; advanced trading tools, low foreign exchange fees. |

| Lightyear | Gaining traction due to its low fees and interest on uninvested cash. | Low trading fees; 3.25% interest on uninvested cash; simple user interface. |

| Trade Republic | Attracting users with its commission-free trading and interest on cash deposits. | €1 external fee per trade; 2% interest on uninvested cash; intuitive mobile app. |

| Revolut | Popular among those seeking an all-in-one financial app, despite higher fees compared to others. | Integrated with banking services; limited free trades per month; higher fees after free limit. |

| Davy Select | Recognised for its comprehensive investment options and strong customer service. | Access to a wide range of investments, high-quality research tools, and higher fees. |

Before opening a trading account in Ireland, it’s important to evaluate a few key factors.

First, make sure the broker is authorised by the Central Bank of Ireland or a recognised EU regulator—this ensures your funds and data are protected.

Check the minimum deposit amount, as some platforms require as little as €50 to get started, while others may ask for more. For beginners, choosing a platform with strong user-friendliness can make the learning curve much smoother.

Finally, consider your personal risk tolerance and investment goals before diving in—trading isn’t a get-rich-quick scheme, and a thoughtful approach goes a long way.

5 Mistakes I Made When Choosing a Trading Platform

Let me save you a headache—I’ve made enough mistakes when picking trading platforms for the both of us. Here are five lessons I learned the hard way:

Ignoring Fees: When I first started, I focused on the “free to join” aspect and ignored fees like $5 per withdrawal or overnight charges for holding positions. Those small fees added up fast, eating into my profits.

Skipping the Regulation Check: I once signed up for an unregulated platform (rookie mistake), and let’s just say the experience wasn’t pretty. Stick to platforms regulated by trustworthy authorities like the FCA or the Central Bank of Ireland. You’ll thank yourself later.

Going Too Advanced Too Soon: I jumped straight into a platform loaded with pro-level tools thinking it would make me a better trader. It didn’t. All it did was confuse me. Start with beginner-friendly platforms like eToro or AvaTrade if you’re new to this world.

Ignoring Customer Support: I can’t stress this enough—customer support matters. There’s nothing worse than running into a technical issue and being left in the dark. Look for platforms with 24/7 support or, at the very least, fast response times.

Not Testing the Demo Account: This one’s free, so there’s no excuse. Use demo accounts to get comfortable with the platform’s layout and features before committing real money. It’s like trying on shoes before buying—essential, really.

Avoid these mistakes, and you’ll save yourself a lot of frustration. The right platform can make all the difference, so take your time, explore the options, and trust your instincts.

What Do I Need to Consider Before Trading?

Can I trust these platforms?

Reliable trading platforms operate under a strict regulatory framework, often authorised by the Central Bank of Ireland, which ensures strong regulatory compliance and robust investor protection. These brokers are typically registered as legitimate legal entities and provide access to a wide range of financial instruments with adequate liquidity.

If you are unsure, you should consult verified broker data to avoid unregulated or suspicious firms.

A trustworthy broker also prioritises high-quality client service, helping you align your trades with your investment goals. By choosing a regulated and reputable broker, you gain peace of mind and a safer path to participating in the markets.

Summary and Key Takeaways

Choosing the best trading platform in Ireland depends on your specific needs:

For beginners, eToro stands out with its user-friendly interface and social trading features.

If you prioritize low fees, Pepperstone and XTB are excellent options.

Traders looking for asset diversity should consider AvaTrade or IG.

For premium services and a wider asset range, Saxo is a top choice.

Take the time to assess your trading goals, compare the platforms, and start small to build confidence. With the right platform, you can make informed trades and grow your portfolio successfully.

Get Up To $500

Worth In Free Assets

- New users only

- Choose from 6 select stocks & crypto

- Funds held 90 days

Terms apply. Your capital is at risk.

FAQs

Do I need to pay tax on stock trading profits in Ireland?

Yes, profits from stock trading are subject to Capital Gains Tax (CGT) in Ireland. The current CGT rate is 33%. It’s important to keep track of your trades and consult a tax advisor or Revenue guidance when filing your returns.

Are Irish trading platforms regulated?

Yes, reputable trading platforms operating in Ireland should be authorised by the Central Bank of Ireland or another recognised EU financial regulator under MiFID II. Always check a broker’s regulatory status before signing up.

Can I invest in US or global stocks from Ireland?

Definitely. Most modern platforms in Ireland give access to global markets, including the US, UK, and European exchanges. You can buy international stocks, ETFs, and even participate in IPOs through certain brokers.

What fees should I be aware of when trading in Ireland?

Look out for stock trading fees, such as commissions per trade, FX conversion fees, inactivity fees, and spreads. These vary by platform, so it’s worth comparing before you choose.

Is it possible to start trading stocks in Ireland as a beginner?

Yes! Many brokers offer beginner-friendly interfaces and educational tools like eToro Academy. It’s wise to start with small investments while you learn how earnings multiples, risk, and portfolio diversification work.

References

- Central Bank of Ireland – Register of Authorised Firms and Investment Brokers

- Revenue.ie – Capital Gains Tax on Shares and Investments

- eToro Academy – Beginner Guides and Trading Education